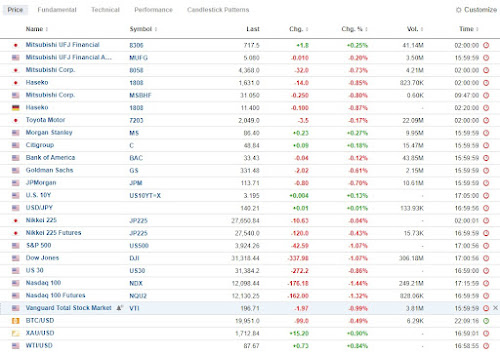

AI 株価予測 20220922の状況8306MUFG

Stock Price AI Forecast - 20220922 Status 8306MUFG

FOMCの0.75%利上げで米株は再度ダイビング。週明けの日本は暴落予想。敗退間近のプーチンは30万人の徴兵と再度の核の脅し。FOMC decided 0.75% rate hike that invited another diving of stock market. Japan stock this week is expected to show another big fall. Putin declared 300K conscription with nuclear threat once more facing the total failure of Ukraine invasion.

黒田はついにドル円介入。30兆円の為替差益が見込める。米国債には売り圧力で米金利高要因だが、FEDの政策には合致。ただ、100兆円程度では限界があり、黒田交代後の利上げまでの一時策か。BOJ Kuroda finally activated JPY support intervention. Expecting over JPY30tr FX gain. This is sell pressure for US treasury, then interest rate hike pressure as well however, this is in line with FED's policy of rate hike. Nevertheless, JPY100tr capacity of intervention has limitation, hence it will be a support until the final JPY rate hike coming after Kuroda's regime.

AI予測は不変。No change on AI forecast. 日足、週足は上げ、月足は下げ。AI forecasted up for day and week, while down for month.

三菱商事も下落するだろうが放置。Mitsubishi trading may fall but will leave it.

長谷工は上抜けの気配がある。放置。Haseko looks going up. Leave it.

米国では共和党側のTVキャスターが敵(バイデン)の敵(プーチン)は味方とばかり、反ウクライナキャンペーンを展開。今後の米国のウクライナ支援低下が懸念。In US, Republican side TV caster has been extending anti Ukraine campaign and becoming a worry for decline of Ukraine support from US going forward. The logic behind looks enemy(Biden)'s enemy(Putin) is a friend.