AI 株価予測 20240222の状況8306MUFG

Stock Price AI Forecast - 20240222 8306MUFG

今週の株はドラマチックだった。22日木曜日の朝6AMのNvidia決算に向け、米株は下落、決算が良かったことを受けて、急騰。日経平均は月曜は高かったものの、木曜日に向けて下落、22日はNvidiaの好決算を受けて急騰した。23日、米株も同様に急騰した。This week's stock market was dramatic. U.S. stocks fell as they approached Nvidia's earnings announcement at 6 a.m. on Thursday the 22nd, but surged following the positive earnings report. While the Nikkei average was high on Monday, it declined towards Thursday, only to surge on the 22nd following Nvidia's strong earnings. On the 23rd, U.S. stocks similarly surged.

ただ、米株はレンジ上限の抵抗線で跳ね返されるタイミングでもあり、Nvidiaの好決算だけで上昇を継続できるかは不透明。However, U.S. stocks also experienced resistance at the upper limit of the range, raising uncertainty about whether the rise can be sustained solely by Nvidia's strong earnings.

米商業用不動産の下落に伴う地銀破綻の懸念があるが、破綻は地銀に限定される。3月11日にBTFP(Bank Term Funding Program)が終了する。BTFPマネーサプライの減少を20兆円ほど弱めてきたが、延長されない限り、3月11日以降は期待できないためリスクは高まる。Concerns about regional bank failures due to the decline in US commercial real estate persist, although such failures are expected to be confined to regional banks. The Bank Term Funding Program (BTFP) is set to expire on March 11th. While the reduction in BTFP money supply has weakened by about 20 trillion yen, without an extension, expectations for its impact after March 11th are bleak, thus raising risks.

中国株の下落は一旦落ち着いてきている模様。It appears that the decline in Chinese stocks has temporarily eased.

MUFGについては月曜高く、その後、株式指数につられ下落したが、Nvidiaの上昇とともに下げ止まり。Regarding MUFG, its stock price was high on Monday, then it declined in line with the stock index, but stabilized alongside Nvidia's rise.

長谷工は下値抵抗線で反発、三菱商事は上昇継続。Haseko rebounded at the lower resistance, while Mitsubishi Trading kept rising.

半導体ETF、SBGは週初から下落していたが、Nvidiaの急騰を受けて急騰。The semiconductor ETF, SBG, had been declining since the beginning of the week, but surged following Nvidia's sharp rise.

トレード詳細はこちら。トレード枠利用は1/3。長期枠利用は4/5。Trade details are here. 1/3 trading limit holding at the point of weekend. Long term holding utilization is 4/5.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing as COVID relief funds continue to deplete.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The world wide stock market crash stemming from US market crash will happen in few months.

米逆イールドは健在。US reverse yield curve still presents.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

ドル円はドル金利の戻りにより上昇。The USD/JPY went up due to US$ interest rate recovery.

新値は日足・週足・月足とも上昇。AI予測は日足、週足、月足とも上昇。The new 3LB highs are ascending across daily, weekly, and monthly charts. AI predictions indicate an upward trend across the daily, weekly and monthly charts.

三菱商事は年初来高値達成。 MItsubishi achieved all time high.

長谷工のMACDはゴールデンクロス達成。Haseko achieved golden cross on MACD.

共和党予備選でトランプ大統領は勝ち進み、大統領選はトランプとバイデンの対決となりそうだ。トランプが大統領となると、世界の警察官は不在となり、軍事力の強い国家が弱い国家を攻め落とす、混沌の時代の始まりとなりそうだ。日本も日米安保条約を解消されれば、ウクライナどころの話ではなくなる。北方領土返還どころでなく、北海道もロシアに侵略・併合されそうだ。よって、日本における軍事力爆増、徴兵制度の復活も現実の話となろう。今年11月6日の米大統領選は日本にとっても非常に重要な意味を持つ。In the Republican primary, President Trump has been advancing, and it looks like the presidential election will come down to a showdown between Trump and Biden. If Trump becomes president, it seems that the world's police force will be absent, leading to a chaotic era where militarily strong nations may attack weaker ones. For Japan, if the Japan-U.S. security treaty is dissolved, it would pose a serious threat beyond just the issue of Ukraine. It's not just about the return of the Northern Territories; even Hokkaido could be invaded and annexed by Russia. Therefore, the talk of a significant increase in Japan's military power and the revival of conscription might become a reality. The U.S. presidential election on November 6th this year holds very significant implications for Japan as well.

平和を唱えているだけで平和が来ると信じている多くの日本人がパニックに陥るのも時間の問題だ。It's only a matter of time before many Japanese, who believe that peace will come simply by advocating for it, fall into panic.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

Nvidiaの決算は結果、期待を裏切らず、NY株は上昇した。しかし、チャート的な抵抗線に近付いたため、反落すると予想する向きも多い。Nvidia's earnings did not disappoint, as a result, NY stocks rose. However, due to approaching a resistance line on the chart, many expect a downturn.

現状のSP500の時価総額パイチャート。インテルが0.4%でNvidaが4%。The current market capitalization pie chart of the S&P 500: Intel at 0.4%, Nvidia at 4%.

今回のLLM-AIの引き金を引いたOpenAIはまだ姿が無いし、AIのロジックを実際に作っている上場銘柄はAlphabetだけ。アルトマンの動き一つで、ここにまた巨大なLLM AI会社が誕生すれば、それは本当のAI。ただの処理加速装置だけの存在であるNvidiaがここまで巨大な時価総額になるのはなんか行き過ぎ。加速装置ならインテルでもいくらでも作れる。OpenAI, which triggered this round of LLM-AI, has yet to appear, and Alphabet is the only listed stock actually creating AI logic. If another huge LLM AI company emerges here due to Altmann's movements, that would be real AI. Nvidia, merely an accelerator, seems to have gone too far to achieve such a massive market capitalization. If it's just an accelerator, Intel could produce as many as needed.

GPUがベクター処理を高速化させるのは間違いないが、Nvidiaの先行者利益の有効期限は長くて2年。7割を超える粗利益率はCUDAによる囲い込みでの寡占による一時的な先行者利益。While GPUs undoubtedly accelerate vector processing, Nvidia's window of opportunity as a pioneer lasts at most two years. Its gross profit margin, exceeding 70%, is a temporary advantage due to monopolization through CUDA.

Nvidiaがこの巨大な時価総額をチャンスに、株式交換などで、OpenAIなどを逆に取り込めば、さらに面白いことになりそう。そうでないと、このまま、上がって下がって終わり。If Nvidia leverages this massive market capitalization to incorporate companies like OpenAI through stock exchanges, it could lead to even more interesting developments. Otherwise, it might just rise and fall without significant change.

現状のSP500の時価総額パイチャート。インテルが0.4%でNvidaが4%。The current market capitalization pie chart of the S&P 500: Intel at 0.4%, Nvidia at 4%.

今回のLLM-AIの引き金を引いたOpenAIはまだ姿が無いし、AIのロジックを実際に作っている上場銘柄はAlphabetだけ。アルトマンの動き一つで、ここにまた巨大なLLM AI会社が誕生すれば、それは本当のAI。ただの処理加速装置だけの存在であるNvidiaがここまで巨大な時価総額になるのはなんか行き過ぎ。加速装置ならインテルでもいくらでも作れる。OpenAI, which triggered this round of LLM-AI, has yet to appear, and Alphabet is the only listed stock actually creating AI logic. If another huge LLM AI company emerges here due to Altmann's movements, that would be real AI. Nvidia, merely an accelerator, seems to have gone too far to achieve such a massive market capitalization. If it's just an accelerator, Intel could produce as many as needed.

GPUがベクター処理を高速化させるのは間違いないが、Nvidiaの先行者利益の有効期限は長くて2年。7割を超える粗利益率はCUDAによる囲い込みでの寡占による一時的な先行者利益。While GPUs undoubtedly accelerate vector processing, Nvidia's window of opportunity as a pioneer lasts at most two years. Its gross profit margin, exceeding 70%, is a temporary advantage due to monopolization through CUDA.

Nvidiaがこの巨大な時価総額をチャンスに、株式交換などで、OpenAIなどを逆に取り込めば、さらに面白いことになりそう。そうでないと、このまま、上がって下がって終わり。If Nvidia leverages this massive market capitalization to incorporate companies like OpenAI through stock exchanges, it could lead to even more interesting developments. Otherwise, it might just rise and fall without significant change.

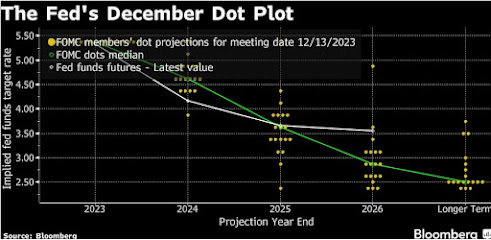

米金利の今後 US FF rate forecast

FOMCでのパウエルの至極まともな答弁を利下げのサインと市場は曲解し、パーティーを始めた。The markets misinterpreted Powell's very reasonable responses during the FOMC as a signal for interest rate cuts and began celebrating prematurely.

ドル金利は、パウエルの利上げ停止の可能性メッセージを曲解、急激に下落。円金利もつられて低下。The dollar interest rates rapidly declined due to a misinterpretation of Powell's message about halting interest rate hikes, causing a drop. This decline also affected yen interest rates, leading to a decrease.

JGB10Y, UST10Y

米インフレ亢進は止まった模様。一部、景気後退のサインも見えるが、全体として景気は強く、利下げを語れる段階にはないのは明らか。It appears that the rapid rise in U.S. inflation has halted. While some signs of an economic slowdown are visible, overall economic conditions remain robust, and it's evident that we're not at a stage where interest rate cuts are being discussed.

US Core Inflation Rate

US Unemployment Rate