AI 株価予測 20230428の状況8306MUFG

ラベル

2023年4月29日土曜日

AI 株価予測 20230428の状況8306MUFG Stock Price AI Forecast - 20230428 8306MUFG

2023年4月23日日曜日

AI 株価予測 20230421の状況8306MUFG Stock Price AI Forecast - 20230421 8306MUFG

AI 株価予測 20230421の状況8306MUFG

Stock Price AI Forecast - 20230421 8306MUFG

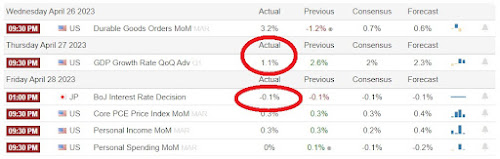

米銀株、USTU10とSPX US Banks, UST10&SPX

米金利の今後 US FF rate forecast

2023年4月18日火曜日

ファンド安定運用方法 Stable Fund Management Method

ファンド安定運用方法 Stable Fund Management Method

株の運用では、現物でも、高値掴み、底値売りの連続で退場となる人は多い。また、信用取引では元手の何倍ものポジションを持つこともでき、退場までの時間は短縮される。Many are forced to get out of stock market by repeated buys at high and sells at the bottom even on cash trading basis. Also for margin trading, one can create position many times bigger than the original fund, making end of game to come faster.

なぜか。Why this happen?

最大の原因は資金管理ができていないから。The biggest reason is the lack of essential skill on risk exposure management.

相場情報を得たい人が最初に知りたいこと。それは、相場が上がるか下がるか。The 1st thing people wish to know about stock market is whether the market will go up or down.

しかし、それより大事なのが資金管理。 However, more importantly, people need to know their own exposure at risk against the whole asset they own.

上がる、下がる事象は予測通りになる保証はどこにもない。 There is no guarantee that stock market will go up or down as they expect.

不確定なものに100%の資金を投入しては、外れた場合にリカバリーが不能。If they put 100% money into the risk asset, recovery will be impossible if market moves against the expectation.

相場格言では「満玉張るな」。Stock market has maxim, 'Never put all money in'.

ここで、ポジポジ病の人には耐えられないかもしれないが、一つの提案。収益は配当+売買益。Here is one proposal although it can be difficult to follow for always-full-investment type of people. Income is dividend, plus trading profit.

自分の全資産を3つに分ける。Divide assets into three.

1/3は高格付け、ディフェンシブな現物、高配当銘柄。売買はOKだが、基本売り切らない。1/3 for highly investment graded, cash basis, defensive, high yield stocks. Can buy & sell but keep the balance forever basically.

1/3はキャッシュだが、高配当銘柄がリーマンショックやコロナ暴落のような大暴落をした時に追加購入する。株価が戻れば売却。1/3 for cash but use to buy more high yield stocks at the time of catastrophic crash such as Lehman shock or Covid-19 crash. Sell of once market recovers.

1/3はリーマンショックや、コロナ暴落を超える想定外の事態が発生した場合の準備。1/3 for real contingency beyond Lehman shock or Covid-19 shock.

これで自己資金運用はかなり安全かつ有効だ。日本株が世界から見放されている現状、配当利回り5%近辺の安定銘柄を探すのには苦労しないからだ。Above provides safe and effective fund management. Currently Japanese stock market is left deserted globally hence it is not difficult to find stocks with stable dividend yield around 5%.

2023年4月14日金曜日

AI 株価予測 20230414の状況8306MUFG Stock Price AI Forecast - 20230414 8306MUFG

AI 株価予測 20230414の状況8306MUFG