AI 株価予測 20250725の状況8306MUFG Stock Price AI Forecast -20250725

米経済指標は経済の20%を占める製造業は悪化する中、80%を占めるサービス業は堅調で全体としては堅調。GDPNowから見ても、景気は強い。インフレは再度上昇を伺う展開。トランプの関税は結局輸出側の各国が売値を関税分だけ下げる結末となりそうで、関税による米インフレ拡大は杞憂に終わりそう。トランプはやみくもにパウエルへ利下げ要求を続けているが、インフレを抑える観点からはまだ利上げは尚早なのは明らか。来週はJOLTS、GDP、FOMC、日銀金利決定会合とあるが、無事通過しそう。U.S. economic indicators show that while the manufacturing sector, which accounts for 20% of the economy, is deteriorating, the services sector, making up 80%, remains solid, leaving the overall economy strong. GDPNow also points to robust growth. Inflation appears poised to rise again. Trump's tariffs will likely end up with exporting countries lowering their selling prices by the tariff amount, meaning concerns about tariffs fueling U.S. inflation may prove unfounded. Trump continues to blindly pressure Powell for rate cuts, but from the perspective of containing inflation, it is clear that rate hikes are still premature. Next week will see JOLTS, GDP, the FOMC meeting, and the Bank of Japan’s policy meeting, but these events are likely to pass without issue.

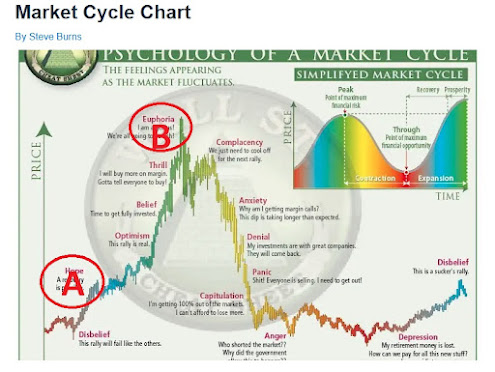

一方、テクニカル的には1930年からのトレンド上限に達し、また、バフェット指数その他のマクロ指数がバブルであることを示している。トランプの放任財政拡大により風船がさらに膨らむ状態で、なにかを切っ掛けに破裂を待っているのは明らか。On the technical side, the market has reached the upper limit of the trend line dating back to 1930, and macro indicators such as the Buffett Indicator are signaling a bubble. With Trump’s laissez-faire fiscal expansion further inflating the balloon, it is clear that the market is just waiting for some trigger to burst.

ただ、悪いシナリオとして、トランプのFRBへの利下げ要求、放漫財政が、さらなるバブルを引き起こす可能性も否定できない。そうなると、米国の金融風船は更に壊滅的な破裂まで突っ走ることになる。当面は1/3程度のリスクポジションを維持することで、万が一の上昇継続の場合にも対応できる。That said, a worse-case scenario cannot be ruled out: Trump’s pressure on the Fed for rate cuts and his reckless fiscal policies could trigger an even larger bubble. If that happens, the U.S. financial bubble could be headed for an even more devastating collapse. For the time being, maintaining a risk position of around one-third allows for flexibility in the event the market continues to rise unexpectedly.

米経済指標は経済の20%を占める製造業は悪化する中、80%を占めるサービス業は堅調で全体としては堅調。GDPNowから見ても、景気は強い。インフレは再度上昇を伺う展開。トランプの関税は結局輸出側の各国が売値を関税分だけ下げる結末となりそうで、関税による米インフレ拡大は杞憂に終わりそう。トランプはやみくもにパウエルへ利下げ要求を続けているが、インフレを抑える観点からはまだ利上げは尚早なのは明らか。来週はJOLTS、GDP、FOMC、日銀金利決定会合とあるが、無事通過しそう。U.S. economic indicators show that while the manufacturing sector, which accounts for 20% of the economy, is deteriorating, the services sector, making up 80%, remains solid, leaving the overall economy strong. GDPNow also points to robust growth. Inflation appears poised to rise again. Trump's tariffs will likely end up with exporting countries lowering their selling prices by the tariff amount, meaning concerns about tariffs fueling U.S. inflation may prove unfounded. Trump continues to blindly pressure Powell for rate cuts, but from the perspective of containing inflation, it is clear that rate hikes are still premature. Next week will see JOLTS, GDP, the FOMC meeting, and the Bank of Japan’s policy meeting, but these events are likely to pass without issue.

一方、テクニカル的には1930年からのトレンド上限に達し、また、バフェット指数その他のマクロ指数がバブルであることを示している。トランプの放任財政拡大により風船がさらに膨らむ状態で、なにかを切っ掛けに破裂を待っているのは明らか。On the technical side, the market has reached the upper limit of the trend line dating back to 1930, and macro indicators such as the Buffett Indicator are signaling a bubble. With Trump’s laissez-faire fiscal expansion further inflating the balloon, it is clear that the market is just waiting for some trigger to burst.

ただ、悪いシナリオとして、トランプのFRBへの利下げ要求、放漫財政が、さらなるバブルを引き起こす可能性も否定できない。そうなると、米国の金融風船は更に壊滅的な破裂まで突っ走ることになる。当面は1/3程度のリスクポジションを維持することで、万が一の上昇継続の場合にも対応できる。That said, a worse-case scenario cannot be ruled out: Trump’s pressure on the Fed for rate cuts and his reckless fiscal policies could trigger an even larger bubble. If that happens, the U.S. financial bubble could be headed for an even more devastating collapse. For the time being, maintaining a risk position of around one-third allows for flexibility in the event the market continues to rise unexpectedly.

トランプの新規政策、戦争など、突発的な暴落に対応するため、今後組み入れても、追加1/3程度で、総組み入れは最大2/3程度。To prepare for sudden market crashes triggered by new Trump policies or potential wars, even if I do resume buying, I plan to limit additional investments to about one-third, with total exposure capped at a maximum of two-thirds.

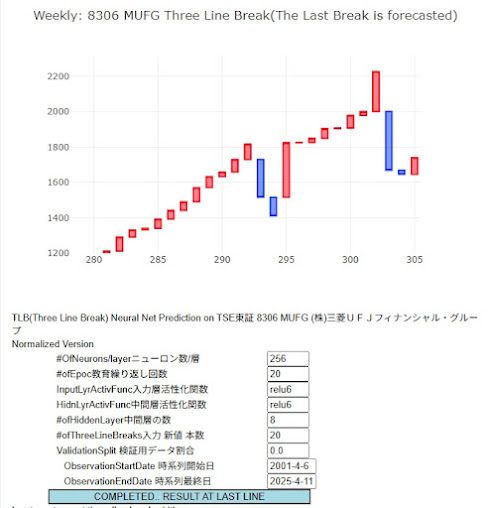

現状、総投資限度の1/3程度の配当重視(配当3%平均)のポジション。MUFG、SMFG、長谷工、三菱商事、村田製作所、トヨタ、金ETF、他。Currently, dividend-focused positions (with an average dividend yield of 3%) account for about one-third of the total investment limit. Holdings include MUFG, SMFG, Haseko, Mitsubishi Corporation, Murata Manufacturing, Toyota, a gold ETF, and others.

トランプの新規政策、戦争など、突発的な暴落に対応するため、今後組み入れても、追加1/3程度で、総組み入れは最大2/3程度。To prepare for sudden market crashes triggered by new Trump policies or potential wars, even if I do resume buying, I plan to limit additional investments to about one-third, with total exposure capped at a maximum of two-thirds.

現状、総投資限度の1/3程度の配当重視(配当3%平均)のポジション。MUFG、SMFG、長谷工、三菱商事、村田製作所、トヨタ、金ETF、他。Currently, dividend-focused positions (with an average dividend yield of 3%) account for about one-third of the total investment limit. Holdings include MUFG, SMFG, Haseko, Mitsubishi Corporation, Murata Manufacturing, Toyota, a gold ETF, and others.

日銀金利決定会合では利上げなしが大方の予想。

IMMは円買いに転換。IMM switched back to JPY buy.

海外勢は買いに転換。Foreign investors started to buy.

新値日足は下落。AI予測は日足が下落。週足が上昇。月足は下落。The new daily candlestick is down. AI predictions indicate the daily candlestick will decline, the weekly candlestick will rise, and the monthly candlestick will decline.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega-banks is characterized more by the uplift of value stocks than the effect of interest rate hikes. Mega-banks have uniformly risen, as have sectors such as construction and heavy industries, which have been undervalued. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, similar to mega-banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

現状日銀は700兆円近くの国債を買い入れており、これは国債発行残高の6割近く。このうち6兆円が毎月満期になるため、月額6兆円を買い入れている。このため、月額買入を3兆円に減額すると1年間に36兆円のQTとなる。全保有額を放出するには20年近くかかるため、それまでは廃止したと言いながら継続しているYCCが続くことになる。これが国債が売られた背景。 Currently, the Bank of Japan holds nearly 700 trillion yen in government bonds, which is close to 60% of the total government bond issuance. Of this amount, 6 trillion yen matures every month, leading the BOJ to purchase 6 trillion yen monthly. Therefore, reducing the monthly purchases to 3 trillion yen results in a QT of 36 trillion yen annually. It would take nearly 20 years to completely unwind their holdings, so despite announcing the end of yield curve control (YCC), it effectively continues. This is why government bonds are being sold off.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE shows a slight recovery trend. Could intervention begin with the USD/JPY pair?

長谷工は下落トレンドから復帰。Haseko showed exit from down-trend.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

米国株はサームルール発動により景気後退入りが確実となった。

今後のシナリオとしては、最初の利下げまでは株価は上昇、最初の利下げを境に下落開始となるシナリオ。The upcoming scenario is that stock prices will continue to rise until the first rate cut, after which they will start to decline.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.

米金利の今後 US FF rate forecast

11月の利下げは0.25%となりそうだ。

米インフレの鎮静化は一時停止状態で、失業率は低下し、景気はまだ強く、インフレ圧力の復活の可能性も秘めているように見える。これがパウエルが利下げを早期に行えない原因。The pacification of US inflation remains suspended, and with a decrease in the unemployment rate and continued strong economy, there seems to be a possibility of a resurgence of inflation pressure. This is the reason why Powell cannot cut interest rates early.