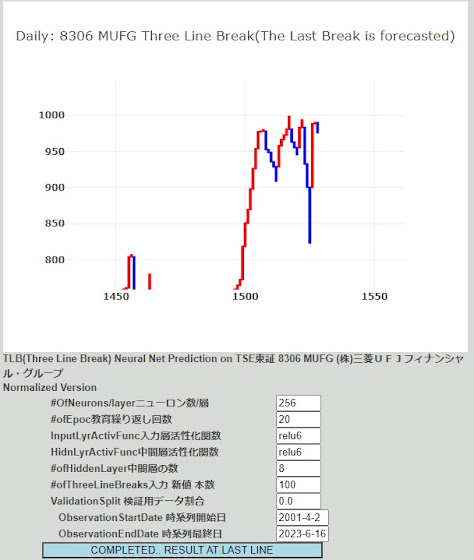

AI 株価予測 20230616の状況8306MUFG

Stock Price AI Forecast - 20230616 8306MUFG

米インフレは低下、パウエルは利上げ見送り、日銀も現状変更を見送った。US inflation has gone down and Powell did not raise rates. BOJ kept rate unchanged as well.

海外投資家の買いは止まらず、指標とともに、MUFGは上昇した。Foreign investor did not stop buying and index as well as MUFG went up.

MUFGは1000円を一時越え、週足ベースではまだ先がありそう。MUFG exceeded 1000 one time implying further up on weekly chart basis.

ただ、秋口に向けて米不動産バブル崩壊から来る大暴落は不可避と考えられ、ここからは売りタイミングを考える。However, US real estate bubble crash as well as US stock crash look inevitable. Hence now it is time to find out sell timing.

3/3 limit holding at the point of weekend. Long term holding utilization is 3/3.

新値は日、週とも陽転。AI予測は日足下落、週足上昇。3LB reverted upward. AI forecasted downward trend for daily chart, and upward trend for weekly chart.

三菱商事はバフェット効果継続。Mitsubishi kept going up due to Buffet effect.

長谷工も上昇。Haseko went up as well.

ウクライナの反転攻勢はゆっくり進んでおり、早期のロシア全面撤退は難しそうだ。Ukraine counter offensive is going on slowly. Early setback of all Russian invasion looks difficult.

米銀株、USTU10とSPX US Banks, UST10&SPX

米金利の今後 US FF rate forecast

パウエルは年内のさらなる利上げを示唆したが、不動産市場の暴落に起因する米経済のクラッシュが秋口にも懸念されており、年内の利上げは起こらない可能性が高い。Powell implied another rate hike this year however, imminent real estate bubble crash may trigger whole US market this fall, making interest rate hike very difficult.

JGB利回りは40bpに収斂。USTは利下げに向かうだろうか。JGB yield converged to 40bp while UST yield may go down.

米国の逆イールドは極まってきた。US inverse yield is getting extreme.