AI 株価予測 20240315の状況8306MUFG

Stock Price AI Forecast - 20240315 8306MUFG

先週金曜日のNVIDIAの大陰線暴落は果たして日本株の急落の引き金を引いた。週末検討した結果全株売却に決定し月曜寄り付きで全株売却した。The sharp decline in NVIDIA's stock last Friday is believed to have triggered the sudden drop in Japanese stocks. After considering over the weekend, it was decided to sell off all stocks, which was executed at Monday's opening.

MUFGについては幸いにも、利上げ株高の期待が強く、寄り天で始まったため、昨週木曜日につけた年初来高値付近で売却できた。ポートフォリオ全体としてNVIDIAショックからの影響は最小にすることが出来たのは良かった。Fortunately, MUFG was able to be sold near its year-to-date high due to strong expectations of a rate hike and a gap-up opening. It was beneficial to minimize the impact of the NVIDIA shock on the overall portfolio.

新値は日足は下落。週足・月足とも上昇。AI予測は日足、週足、月足とも上昇。The new low for the daily stock chart indicates a decline, while the weekly and monthly charts show an upward trend. AI predictions also suggest an upward trend for daily, weekly, and monthly charts.

中国株は年初から再上昇を始めているが、不動産問題が更に火を噴く可能性が高く、一時的な戻りと考えられる。Chinese stocks have been on the rise since the beginning of the year, but there is a high possibility of further escalation of the real estate issue, which could be considered a temporary rebound.

NVIDIAの大陰線を見て半導体は一律大幅下落。月曜日寄付きでロスカット。The semiconductor industry experienced a significant decline across the board following NVIDIA's sharp downturn, leading to stop-loss orders at Monday's opening.

ソフトバンクはARMの下落を受けて大幅調整。月曜日寄付きでロスカット。SoftBank underwent a significant adjustment following ARM's decline, with stop-loss orders executed at Monday's opening. Mitsubishi Heavy Industries also experienced stop-loss orders at Monday's opening.

三菱重工も月曜日寄付きでロスカット。Mitsubishi Heavy Industries also experienced stop-loss orders at Monday's opening.

トレード詳細はこちら。トレード枠利用は 0/3。長期枠利用は0/5。Details of the trades are as follows: Utilization of trading limits are 0/3 being used for short-term trades and 0/5 for long-term holdings.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing as COVID relief funds continue to deplete.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The world wide stock market crash stemming from US market crash will happen in few months.

米逆イールドは健在。US reverse yield curve still presents.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

ドル円は円高。JPY started to be appreciated.

米金利、円金利は上昇。US$ interest rate and JPY interest rate have gone up.

三菱商事はレンジ抵抗線上限にまで上昇。抵抗線を突破し、上昇が確認されたら買い。Mitsubishi Corporation has risen to the upper limit of the descending range resistance. Buying is suggested if resistance is broken and an upward trend is confirmed.

長谷工は下降レンジ脱却の最後の抵抗線をブレークしたら買い。Haseko Corporation is suggested for buying once it breaks the final resistance line to escape the descending range.

もしトラは本トラになる可能性が大きくなってきた。現状トランプの掲げる経済政策は相互に矛盾している。トランプは再度バラマキ支援をする計画だが、同時に、ドル安を実現したいらしく、それには利下げが必要。バラマキの結果、インフレは果てしなく増大、金利は高くなり、ドルは強くなってしまうことを考慮していないようだ。本トラが実現すると、日本はまた大きく翻弄されそうだ。There is a high possibility of Trump turning into a "real tiger". His current economic policies seem contradictory. While planning to provide stimulus support again, he also seems to want a weaker dollar, which would require interest rate cuts. It appears that he is not considering the consequences of stimulus resulting in endless inflation, high interest rates, and a stronger dollar. If this "real tiger" scenario materializes, Japan could be significantly affected again.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

今回の下落がどこまで掘るか。昨年のケースだと、全治3か月。How far this downturn will go remains uncertain. Based on last year's case, the recovery period could be around three months.

3か月でも戻るか、米株の全面崩壊で全治5年になるか。米株がハードランディングする理由はいくつもある。コロナ給付預金の枯渇、失業率の立ち上がり、不動産崩壊開始、地銀連続破綻と政府支援の限界、中国経済破綻で世界GDPの激減、もしトラ不安などなど。なんせ、米国のコロナ支援はGDPの25%だったことが重要。この異常な刺激策の副作用はリーマンショック後の中銀BS拡大に加えて未知の世界。It could rebound within three months, or if there's a complete collapse of the US stock market, it could take five years for recovery. There are several reasons why the US stock market could experience a hard landing, such as the depletion of coronavirus relief funds, rising unemployment rates, the beginning of a real estate collapse, consecutive failures of regional banks reaching the limits of government support, a sharp decline in global GDP due to the collapse of the Chinese economy, and geopolitical tensions. After all, the fact that US coronavirus relief amounted to 25% of GDP is significant. The side effects of this abnormal stimulus package, added to the expansion of central bank balance sheets after the Lehman shock, lead to an unknown territory.

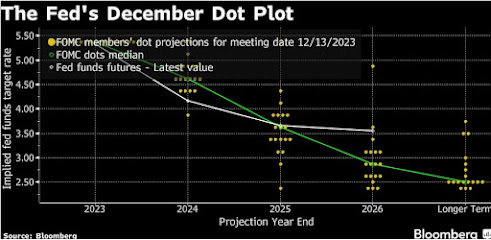

ハードランディングを防ぐためにパウエルが逆イールド解消まで利下げすると、皮肉にも、ハードランディング開始の狼煙となる。ハードランディングのもう一つのトリガーである失業率が実質上昇傾向にあるが、しかしこのタイミングで利下げすると、インフレを2%以下にできないジレンマ。Ironically, if Powell lowers interest rates until the yield curve inversion is resolved to prevent a hard landing, it may ironically signal the beginning of the hard landing. Another trigger for a hard landing is the upward trend in the unemployment rate, but lowering interest rates at this point creates a dilemma of not being able to keep inflation below 2%.

3月9月は外人売りが出やすいアノマリーも。March and September tend to see anomalies where foreign selling is more likely.

一方、AIハイテクの物語は、未だ、最終消費者までのサイクルが完成しておらず、まだ物語ベースでの買いが続いていた。NVIDIAも、データセンター向けのサイクルだけでは成長に限界があるのを自ら示している。On the other hand, the AI high-tech narrative hasn't fully completed its cycle to reach the end consumer, and buying based on the narrative continues. NVIDIA, for example, has shown that growth is limited solely to the data center cycle.

植田は基本、国民生活より供給者側を支援するアベノミクス側の人。通貨の番人など、とっくに返上している。いくら緩和してもインフレにならなかった日本をインフレにしてくれた円安を、やすやすと手放すことは無いかも。株価の本格崩壊が始まったら、異次元緩和の延長もあるか。もしくは、解除後もカーブ実質介入しまくり等々。Mr. Ueda fundamentally supports the supply side of Abenomics rather than the livelihoods of the citizens. He has long since given up the role of currency guardian, among others. It's possible that he won't easily give up the yen depreciation that brought inflation to Japan, which had failed to materialize no matter how much easing was done. If a full-scale collapse in stock prices begins, there may be an extension of unconventional easing measures. Alternatively, there could be continued substantial intervention in the yield curve even after the tapering.

色々考えると、不確定要素満載で、次のトレンドが現れるまで一旦手じまいという人も多いだろう。With so many uncertainties, many people might choose to sit on the sidelines until the next trend emerges.

米金利の今後 US FF rate forecast

FOMCでのパウエルの至極まともな答弁を利下げのサインと市場は曲解し、パーティーを始めた。The markets misinterpreted Powell's very reasonable responses during the FOMC as a signal for interest rate cuts and began celebrating prematurely.

米インフレ亢進は止まった模様。一部、景気後退のサインも見えるが、全体として景気は強く、利下げを語れる段階にはないのは明らか。It appears that the rapid rise in U.S. inflation has halted. While some signs of an economic slowdown are visible, overall economic conditions remain robust, and it's evident that we're not at a stage where interest rate cuts are being discussed.

US Core Inflation Rate

US Unemployment Rate新値は日足は下落。週足・月足とも上昇。AI予測は日足、週足、月足とも上昇。The new low for the daily stock chart indicates a decline, while the weekly and monthly charts show an upward trend. AI predictions also suggest an upward trend for daily, weekly, and monthly charts.

[今回予測20240315]Forecast at this time

[前回予測20240308]Previous Forecast

新値は日足は下落。週足・月足とも上昇。AI予測は日足、週足、月足とも上昇。The new low for the daily stock chart indicates a decline, while the weekly and monthly charts show an upward trend. AI predictions also suggest an upward trend for daily, weekly, and monthly charts.

[今回予測20240315]Forecast at this time

[前回予測20240308]Previous Forecast