AI 株価予測 20240712の状況8306MUFG

Stock Price AI Forecast -20240712

先週は大波乱だった。突如日経平均が大きく上場来高値を更新し、パウエルの発言により早期利下げ観測が強まった。翌日米CPIの発表はインフレの更なる鎮静化を示した。ところが、NASDAQが急落、同時にドル円は財務省の大規模介入で3円安、日経平均は窓を開けて1000円程下落した。三菱UFJ、三菱重工なども大幅に下落した。Last week was full of upheavals. Suddenly, the Nikkei Stock Average reached a new all-time high, and Powell's statements intensified expectations of an early interest rate cut. The next day, the announcement of the US CPI indicated a further calming of inflation. However, the NASDAQ plummeted, and simultaneously, the dollar-yen exchange rate dropped by 3 yen due to massive intervention by the Ministry of Finance, causing the Nikkei to open with a gap and drop by about 1,000 yen. Mitsubishi UFJ and Mitsubishi Heavy Industries also experienced significant declines.

さらに週末、元米大統領トランプが大統領選でペンシルベニアで演説中暗殺されかかった。結果トランプは殆ど無傷で強いものが好きな米国民に、闘う強いトランプのイメージを強烈に植え付ける結果となった。トランプの支持率はさらに上昇した。Furthermore, over the weekend, former US President Trump was nearly assassinated during a speech in Pennsylvania as part of the presidential election campaign. As a result, Trump emerged almost unscathed, which strongly reinforced his image as a strong fighter among Americans who admire strength. Consequently, Trump's approval ratings further increased.

メガバンク各社は下落した。三井住友は上昇チャネル内には留まっている。The megabanks all fell, though Sumitomo Mitsui remained within its upward channel.

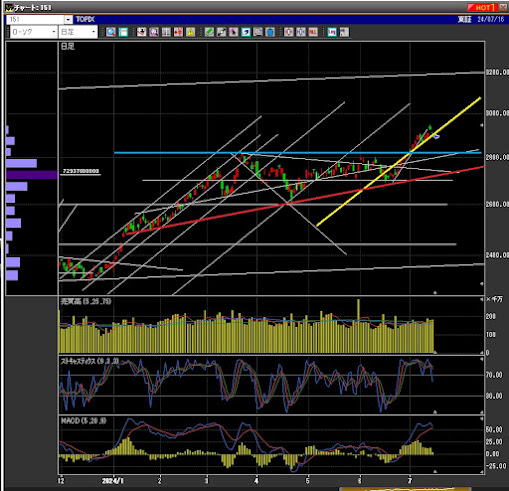

新値日足は全て上昇。AI予測は日足、週足が上昇。月足は下落。The new daily highs are all rising. The AI prediction shows an increase in daily and weekly charts, while the monthly chart is predicted to decline.

中国株は年初から再上昇を始めているが、不動産問題が更に火を噴く可能性が高く、一時的な戻りと考えられる。Chinese stocks have been rebounding since the beginning of the year, but there is a high possibility of further escalation of the real estate issue, suggesting a temporary rebound.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

今週は雇用統計など、米経済減速を示す経済指標の発表が相次いだ。来週は、木曜日のインフレ率発表。This week saw the release of various economic indicators pointing to a slowdown in the U.S. economy, including employment statistics. Next week, the inflation rate will be announced on Thursday.

決算は山場を越えた。日経平均EPSに大きな変化はなかった。The earnings season has peaked. There was no significant change in the Nikkei 225's EPS.

長谷工は下落トレンドに復帰。Haseko went back to down-trend.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

米国株はトランプの暗殺未遂を経て、ダウも上場来高値を実現した。

今後のシナリオとしては、最初の利下げまでは株価は上昇、最初の利下げを境に下落開始となるシナリオ。The upcoming scenario is that stock prices will continue to rise until the first rate cut, after which they will start to decline.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

NYのVIXは下落。NY VIX has gone down.

FEAR&GREEDは中立強欲へ戻る。Fear&Greed has gone back to greed.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

NYのVIXは下落。NY VIX has gone down.

FEAR&GREEDは中立強欲へ戻る。Fear&Greed has gone back to greed.

米金利の今後 US FF rate forecast

パウエルのハト派的コメントで年内利上げは再度3回予測となった。Rate ease expectation has now gone up to three times once more due to dovish comment by Powell.

米インフレの鎮静化は一時停止状態で、失業率は低下し、景気はまだ強く、インフレ圧力の復活の可能性も秘めているように見える。これがパウエルが利下げを早期に行えない原因。The pacification of US inflation remains suspended, and with a decrease in the unemployment rate and continued strong economy, there seems to be a possibility of a resurgence of inflation pressure. This is the reason why Powell cannot cut interest rates early.