AI 株価予測 20240517の状況8306MUFG

Stock Price AI Forecast -20240517

来週はNVIDIAの決算があり、米株は上下に振れる。米株は2月のNVIDIAの決算後、急落、調整していたが、ここにきて上場来高値を更新する直前まで戻ってきた。決算結果により上場来高値を更新する可能性があるが、もし、市場の期待に沿えなかった場合、2月決算のように再度調整を開始する可能性もある。Next week, NVIDIA's earnings report will be released, causing U.S. stocks to fluctuate. After NVIDIA's earnings in February, the stock experienced a sharp decline and subsequent correction, but it has now almost reached its all-time high. Depending on the earnings results, there is a possibility that the stock will hit a new all-time high. However, if the results fail to meet market expectations, another correction, similar to the one in February, might occur.

NY株は景気後退のシグナルを無視した、利下げ期待と、AIのみを拠り所にした上昇となっているが、何時までも続くわけはない。しかし、本格的な暴落までは上昇が継続すると考えられ、上昇には当面ついていく方が有利だろう。このため、市場には半身で参加する必要がある。今週木曜日に向けて、ポジションは1/5とし、上昇すれば収益となり、年初来高値の1650近辺で一旦利益確定する。NY stocks are rising, driven by interest rate cuts expectations and reliance on AI while ignoring signals of an economic downturn. However, this upward trend cannot continue indefinitely. Nonetheless, it is believed that the upward trend will persist until a significant crash occurs, so it may be advantageous to follow along with the rise for the time being. Therefore, it is necessary to participate cautiously in the market. Towards this Thursday, positions should be at 1/5, and if the market rises, profits will be made, and profits should be realized around the year-to-date high of around 1650 yen.

下落した場合のシナリオとしては、今後金利は上昇過程にあるシナリオは崩れていないと思われるため、1300円台に向かって下落した場合、追加で更に1/5のポジションを追加する。さらに1100円台に向かって下落した場合、更に1/5と買い下がっていく。As for scenarios in case of a decline, since the scenario where interest rates are in the process of rising has not collapsed, if the market falls towards the 1300 yen range, an additional 1/5 position should be added. Furthermore, if it falls towards the 1100 yen range, further buying should be done at 1/5 increments.

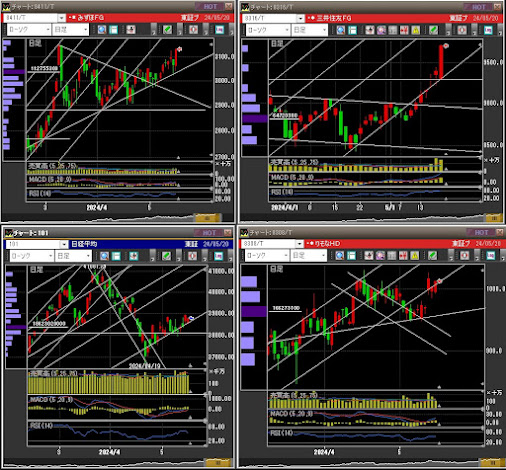

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega-banks is characterized more by the uplift of value stocks than the effect of interest rate hikes. Mega-banks have uniformly risen, as have sectors such as construction and heavy industries, which have been undervalued. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, similar to mega-banks.

いよいよ運命のNVIDIA決算が来週水曜日にある。木曜日の日本株は大変なことになりそう。The long-awaited NVIDIA earnings announcement is coming next Wednesday. Japanese stocks on Thursday are likely to be significantly impacted.

決算は自社株買いで明暗。自社株買いの大きいSMBCは上昇、少ないMUFGは下落した。Earnings reports highlighted a contrast in stock performance based on share buybacks. SMBC, with significant share buybacks, saw its stock rise, while MUFG, with fewer buybacks, experienced a decline.

新値日足は下落。AI予測は日足、週足、月足とも上昇。The new daily highs are falling. AI predictions indicate an upward trend on weekly, and monthly charts but falling for daily.

中国株は年初から再上昇を始めているが、不動産問題が更に火を噴く可能性が高く、一時的な戻りと考えられる。Chinese stocks have been rebounding since the beginning of the year, but there is a high possibility of further escalation of the real estate issue, suggesting a temporary rebound.

トレード詳細はこちら。トレード枠利用は 2/5。長期枠利用は0/5。Trading details are as follows: 1/5 trading limit utilization for short-term trades and 0/5 for long-term holdings.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

決算は山場を越えた。日経平均EPSに大きな変化はなかった。The earnings season has peaked. There was no significant change in the Nikkei 225's EPS.

US$は未だ100bpの逆イールド状態。日本円は100bpの順イールド。The US dollar is still in a 100bp reverse yield curve, while the Japanese yen has a 100bp forward yield curve.

米金利は年内利下げ可能性の低下に伴い上昇したが、ハイテクの好調な決算の安心感からか上昇。日本の金利は急激な円安から日銀が利上げするのではとの思惑から上昇したが、結果現状維持だったので、反落した。U.S. interest rates rose as the likelihood of a rate cut this year diminished. However, buoyed by strong earnings reports from the tech sector, stocks climbed. In Japan, interest rates initially rose due to speculation that the Bank of Japan might raise rates in response to rapid yen depreciation. However, when the BOJ decided to maintain its current policy, rates fell back down.

ドル円は神田財務官により介入が入り急落。原資は1億ドルあるので、160円は防衛可能化もしれない。外貨準備が尽きたところで、金利を上げれば良いわけだ。The USD/JPY experienced a sharp decline due to intervention by Finance Minister Kanda. With reserves of $100 million, it may be possible to defend the 160 yen level. If foreign reserves are depleted, raising interest rates could be an option.

米金利、円金利は上昇。US and Japanese interest rates have risen.

長谷工は下落トレンドから一時離脱したが、また戻りそうだ。Haseko momentarily departed from its downtrend but seems to be returning.

長谷工の決算はインフレによるコスト高を反映した減益となった。Haseko's financial results showed a decrease in profit, reflecting higher costs due to inflation.

ウクライナ支援の米議会承認はようやく成立した。武器は前線に届きつつあり、劣勢を回復しつつあるようだ。The approval from the US Congress for aid to Ukraine has finally been achieved. Weapons are beginning to reach the front lines, and it seems that the Ukrainian forces are gradually regaining their footing.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

今回の下落がどこまで掘るか。昨年のケースだと、全治3か月。How far this downturn will go remains uncertain. Based on last year's case, the recovery period could be around three months.

3か月でも戻るか、米株の全面崩壊で全治5年になるか。米株がハードランディングする理由はいくつもある。コロナ給付預金の枯渇、失業率の立ち上がり、不動産崩壊開始、地銀連続破綻と政府支援の限界、中国経済破綻で世界GDPの激減、もしトラ不安などなど。なにせ、米国のコロナ支援はGDPの25%だったことが重要。この異常な刺激策の副作用はリーマンショック後の中銀BS拡大に加えて未知の世界。It could rebound within three months, or if there's a complete collapse of the US stock market, it could take five years for recovery. There are several reasons why the US stock market could experience a hard landing, such as the depletion of coronavirus relief funds, rising unemployment rates, the beginning of a real estate collapse, consecutive failures of regional banks reaching the limits of government support, a sharp decline in global GDP due to the collapse of the Chinese economy, and geopolitical tensions. After all, the fact that US coronavirus relief amounted to 25% of GDP is significant. The side effects of this abnormal stimulus package, added to the expansion of central bank balance sheets after the Lehman shock, lead to an unknown territory.

ハードランディングを防ぐためにパウエルが逆イールド解消まで利下げすると、皮肉にも、ハードランディング開始の狼煙となる。ハードランディングのもう一つのトリガーである失業率が実質上昇傾向にあるが、しかしこのタイミングで利下げすると、インフレを2%以下にできないジレンマ。Ironically, if Powell lowers interest rates until the yield curve inversion is resolved to prevent a hard landing, it may ironically signal the beginning of the hard landing. Another trigger for a hard landing is the upward trend in the unemployment rate, but lowering interest rates at this point creates a dilemma of not being able to keep inflation below 2%.

3月9月は外人売りが出やすいアノマリーも。March and September tend to see anomalies where foreign selling is more likely.

一方、AIハイテクの物語は、未だ、最終消費者までのサイクルが完成しておらず、まだ物語ベースでの買いが続いていた。NVIDIAも、データセンター向けのサイクルだけでは成長に限界があるのを自ら示している。On the other hand, the AI high-tech narrative hasn't fully completed its cycle to reach the end consumer, and buying based on the narrative continues. NVIDIA, for example, has shown that growth is limited solely to the data center cycle.

植田は基本、国民生活より供給者側を支援するアベノミクス側の人。通貨の番人など、とっくに返上している。いくら緩和してもインフレにならなかった日本をインフレにしてくれた円安を、やすやすと手放すことは無いかも。株価の本格崩壊が始まったら、異次元緩和の延長もあるか。もしくは、解除後もカーブ実質介入しまくり等々。Mr. Ueda fundamentally supports the supply side of Abenomics rather than the livelihoods of the citizens. He has long since given up the role of currency guardian, among others. It's possible that he won't easily give up the yen depreciation that brought inflation to Japan, which had failed to materialize no matter how much easing was done. If a full-scale collapse in stock prices begins, there may be an extension of unconventional easing measures. Alternatively, there could be continued substantial intervention in the yield curve even after the tapering.

色々考えると、不確定要素満載で、次のトレンドが現れるまで一旦手じまいという人も多いだろう。With so many uncertainties, many people might choose to sit on the sidelines until the next trend emerges.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

NYのVIXは下落。NY VIX has gone down.

FEAR&GREEDは中立強欲へ戻る。Fear&Greed has gone back to greed.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

NYのVIXは下落。NY VIX has gone down.

FEAR&GREEDは中立強欲へ戻る。Fear&Greed has gone back to greed.

米金利の今後 US FF rate forecast

パウエルのハト派的コメントで年内利上げは再度2回予測となった。Rate ease expectation has now gone up to twice once more due to dovish comment by Powell.

米インフレの鎮静化は一時停止状態で、失業率は低下し、景気はまだ強く、インフレ圧力の復活の可能性も秘めているように見える。これがパウエルが利下げを早期に行えない原因。The pacification of US inflation remains suspended, and with a decrease in the unemployment rate and continued strong economy, there seems to be a possibility of a resurgence of inflation pressure. This is the reason why Powell cannot cut interest rates early.