AI 株価予測 20250418の状況

8306MUFG Stock Price AI Forecast -20250418

トランプは日本を皮切りに20か国以上と個別の関税交渉に入った。中国とはいまだ対決状態。スマホについてはAppleへのダメージを軽減する模様。イーロンマスクは関税に反対の様だがトランプは意に介さない模様。トランプはパウエルの解任も要求しているが、ベッセントが制止している。Trump has begun individual tariff negotiations with over 20 countries, starting with Japan. He remains in a standoff with China. Regarding smartphones, it appears measures will be taken to lessen the damage to Apple. Elon Musk seems to oppose the tariffs, but Trump appears unfazed. Trump is also demanding the dismissal of Powell, though Bessent is holding him back.

トランプ関税の真意は米国の破綻財政の修復にあり、関税は手段にすぎない。貿易不均衡などは表向きの口実。米国の富を一手に握る超富裕層からの徴税するより、庶民から搾り取る方法にしたようだ。ただ、高関税政策は景気を落ち込ませ、株価を下落させるため、超富裕層の資産も相当に傷む。The true intention behind Trump’s tariffs lies in repairing the United States’ broken finances, with tariffs serving merely as a means to that end. Trade imbalances are just a superficial pretext. Rather than taxing the ultra-wealthy who hold most of America's wealth, Trump seems to have opted for extracting revenue from the general public. However, high tariff policies tend to depress economic activity and lower stock prices, which would also significantly damage the assets of the ultra-wealthy.

トランプ政権が高関税での増収から景気後退による関税以外の税収の減少を引いた、ネットの増収を実現できるかどうかは賭けだろう。うまくいけばトランプは米財政を立て直した名大統領として名を残すだろう。現状の高関税は世界景気を相当に冷え込ませるだろうが、大恐慌レベルになることはないだろう。米財政の風船が最大値で大爆発するより、人為的に計画的にガス抜きさせた方が被害が少なくなるからだ。Whether the Trump administration can achieve a net increase in revenue—boosting income through high tariffs while offsetting losses from a recession-induced drop in other tax revenues—is a gamble. If successful, Trump could go down in history as the great president who rehabilitated U.S. finances. The current high tariffs are likely to significantly cool the global economy, though they probably won’t trigger a Great Depression-level crisis. This is because a controlled, deliberate release of economic pressure will likely result in less damage than allowing the ballooning U.S. fiscal crisis to explode at its peak.

今後の世界景気は徐々に落ち込んでいると考えられるが、それが数字に表れてくるのは3か月後ぐらいだろうか。当面は前週の急落からの反発局面が継続するようなチャートとなっている。来週からは企業業績発表もあり、アナリスト予想未達が頻出しそうな気配だ。It is expected that the global economy will continue to gradually decline, although this may not become apparent in the data for another three months or so. For the time being, charts indicate a rebound phase continuing from last week’s sharp drop. Starting next week, corporate earnings announcements will begin, and it seems likely that many companies will miss analysts’ expectations.

現状、総投資限度の1/3程度の配当重視(配当3%平均)のポジション。MUFG、長谷工、三菱商事、村田製作所、トヨタ、金ETF、他。Currently, dividend-focused positions (with an average dividend yield of 3%) account for about one-third of the total investment limit. Holdings include MUFG, Haseko, Mitsubishi Corporation, Murata Manufacturing, Toyota, a gold ETF, and others.

日銀金利決定会合では利上げなしが大方の予想。

IMMは円買いに転換。IMM switched back to JPY buy.

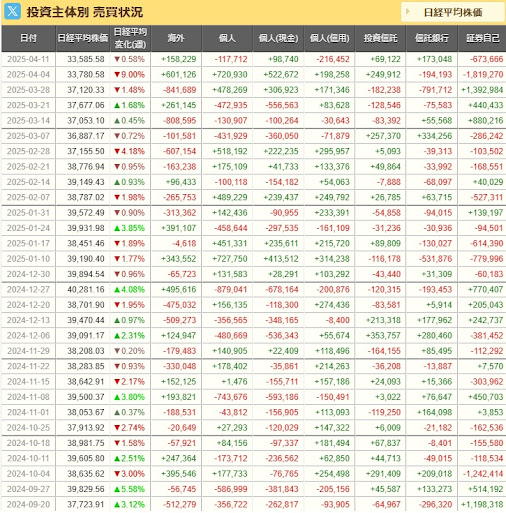

海外勢は買いに転換。Foreign investors started to buy.

新値日足は下落。AI予測は日足が下落。週足が上昇。月足は下落。The new daily candlestick is down. AI predictions indicate the daily candlestick will decline, the weekly candlestick will rise, and the monthly candlestick will decline.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega-banks is characterized more by the uplift of value stocks than the effect of interest rate hikes. Mega-banks have uniformly risen, as have sectors such as construction and heavy industries, which have been undervalued. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, similar to mega-banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

現状日銀は700兆円近くの国債を買い入れており、これは国債発行残高の6割近く。このうち6兆円が毎月満期になるため、月額6兆円を買い入れている。このため、月額買入を3兆円に減額すると1年間に36兆円のQTとなる。全保有額を放出するには20年近くかかるため、それまでは廃止したと言いながら継続しているYCCが続くことになる。これが国債が売られた背景。 Currently, the Bank of Japan holds nearly 700 trillion yen in government bonds, which is close to 60% of the total government bond issuance. Of this amount, 6 trillion yen matures every month, leading the BOJ to purchase 6 trillion yen monthly. Therefore, reducing the monthly purchases to 3 trillion yen results in a QT of 36 trillion yen annually. It would take nearly 20 years to completely unwind their holdings, so despite announcing the end of yield curve control (YCC), it effectively continues. This is why government bonds are being sold off.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE shows a slight recovery trend. Could intervention begin with the USD/JPY pair?

長谷工は下落トレンドから復帰。Haseko showed exit from down-trend.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

米国株はサームルール発動により景気後退入りが確実となった。

今後のシナリオとしては、最初の利下げまでは株価は上昇、最初の利下げを境に下落開始となるシナリオ。The upcoming scenario is that stock prices will continue to rise until the first rate cut, after which they will start to decline.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.FEAR&GREEDはへ強欲へ FEAR&GREED dived into greed.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.

FEAR&GREEDはへ強欲へ FEAR&GREED dived into greed.

米金利の今後 US FF rate forecast

11月の利下げは0.25%となりそうだ。

米インフレの鎮静化は一時停止状態で、失業率は低下し、景気はまだ強く、インフレ圧力の復活の可能性も秘めているように見える。これがパウエルが利下げを早期に行えない原因。The pacification of US inflation remains suspended, and with a decrease in the unemployment rate and continued strong economy, there seems to be a possibility of a resurgence of inflation pressure. This is the reason why Powell cannot cut interest rates early.