AI 株価予測 20231102の状況8306MUFG

Stock Price AI Forecast - 20231102 8306MUFG

日銀金利決定は10年金利の1%上限を1%めどに変更、FRB金利決定は変わらず、米国失業率は0.1%悪化となった。金利がピークアウトしたと考えて米10年金利は下落、米株は急上昇。これを受けて、日本株は空売りの巻き戻しで大幅に上昇。 FOMCでパウエルがこんな金利で住宅を買う奴やいないだろうと発言。During FOMC, Powell said no one will buy home under current high interest rate. BOJ interest rate decision resulted abolition of 1% limit of 10yr JGB yield replaced by a target around 1%. No change on FRB rate. US unemployment got worse for 0.1%. Taking these as peak out of rate hike, US 10yr treasury yield dropped significant while US stock went up sharply. Seeing this, Japan stock has gone up sharply as well driven by unwinding of short sale.

TOPIXは下落トレンドを離脱。 TOPIX did exit from downtrend.

SP500、TOPIXとも上昇が急激で、チャート的には一旦反落する形。11月は上昇アノマリーがある。しかしTOPIXは結局SP500のトレンドには逆らえないため、SP500が下落トレンドから離脱してから買う方が安全。Since both SP500 and TOPIX is increasing sharply, it is forming a chart pattern to decline for a moment. Nov has upward anomaly. However, since TOPIX eventually follows SP500, it will be safer to buy after confirming that SP500 does exit from downtrend.

今週はSQなので、株高に誘導しようとする流れもあるだろう。また、市場は金利の高止まりの意味するところを消化しないまま金利低下をはやして再上昇しているが、頭が冷えてくると我に返って下落再開となる可能性が高い。This week is SQ, hence there maybe a trend to drive stock price upward. Also need to consider is the fact that market is no really digesting the real impact from long term high interest rate. So once cool down enough to think rationally, market may resume downtrend once more.

雇用のさらなる悪化や逆イールド解消が歴史的に株価下落のサインであることから、市場は今後数カ月後の本格的な株式暴落に向けてチキンレースの様相を呈している。Since further deterioration of employment as well as normalization of inverse yield curve indicate the stock decline historically, market may be in a chicken race towards a major market crash coming up in few month.

トレード詳細はこちら。トレード枠利用は1/50。長期枠利用は0/3。Trade details are here. 1/50 limit holding at the point of weekend. Long term holding utilization is 0/3.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The world wide stock market crash stemming from US market crash will happen in few months.

逆イールドは健在。Reverse yield curve still presents.

外国人は現物買いをいったん中断。Foreign investors stopped buying Japanese stock in cash.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

ドル円は財務省の大規模な為替介入が始まった。USD/JPY is testing 150 while major intervention by MOF has started.

新値は日足は下落、週足・月足とも上昇。AI予測は日足は下落、週足、月足とも上昇。The stock is currently showing a daily decline in price while experiencing upward trends on the weekly and monthly charts. AI predictions suggest a daily decline but upward trends on both the weekly and monthly charts.

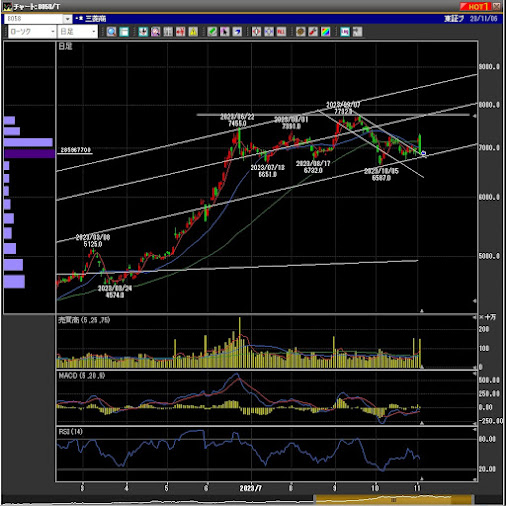

三菱商事は上昇後反落。下落トレンドからは離脱。MTC went up but showed sharp decline. Got out of downward trend.

長谷工も上昇と反落。下落トレンドからは離脱。Haseko has gone up but showed sharp decline as well. Got out of downward trend.

欧米が中東戦争勃発を受けてウクライナに停戦を勧める可能性が報道されており、ロシアの思う壺となる懸念が出てきた。

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

NKYもSPXも暴落目前ムード満載のチャート。だが、現状ではまだ、米商業用不動産破綻、中国経済破綻から来る経済不安をベースとした大暴落には少し早すぎるだろう。それは、まだ米国ドルのイールドカーブの10Y-2Yが未だマイナスだからだ。暴落はこれがプラ転してから始まるのが常だ。NKY as well as SPX chart is telling that crash is imminent. However it will be a little bit early to be a real crash that originates from US commercial real estate crash as well as China economic crash. It is because US 10Y-2Y yield is still negative. Real crash normally comes after 10Y-2Y comes back to positive number.

NKYもSPXも暴落目前ムード満載のチャート。だが、現状ではまだ、米商業用不動産破綻、中国経済破綻から来る経済不安をベースとした大暴落には少し早すぎるだろう。それは、まだ米国ドルのイールドカーブの10Y-2Yが未だマイナスだからだ。暴落はこれがプラ転してから始まるのが常だ。NKY as well as SPX chart is telling that crash is imminent. However it will be a little bit early to be a real crash that originates from US commercial real estate crash as well as China economic crash. It is because US 10Y-2Y yield is still negative. Real crash normally comes after 10Y-2Y comes back to positive number.

米金利の今後 US FF rate forecast

市場は利下げ目線で、パーテイーを始めようとしているが、完全なフライングだろう。4%超の金利が長期間続くことの重みがこれから深く認識されることになる。The market is looking to start the party with a rate cut perspective, but it may be premature. The weight of interest rates above 4% persisting for an extended period will be more deeply recognized in the near future.

ドル金利は5%を付けた後、急落、円金利は1%越え容認ののち、急騰して反落。Dollar interest rate touched 5% but later went down sharp, meanwhile, JPY interest rate has gone up after the revision of YCC policy, then went down sharp.