AI 株価予測 20231215の状況8306MUFG

Stock Price AI Forecast - 20231215 8306MUFG

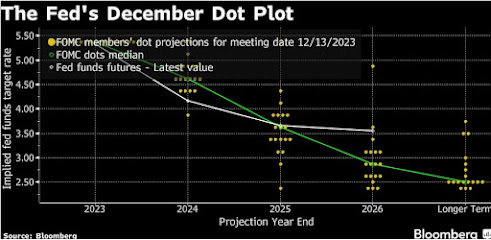

12日10:30PM米インフレ率はサプライズなし、米景気は沈静化しつつあるものの、2%の目標インフレ率達成には利下げは程遠い状態。14日4AMパウエル金利決定は現状維持。ただ、市場はパウエルのごく普通の発言を金利早期低下のサインと誤解し、金利は急低下、ドル円は暴落、株は暴騰した。On December 12th at 10:30 PM, the U.S. inflation rate revealed no surprises, and while the American economy is gradually stabilizing, achieving the 2% target inflation rate seems far from being met through interest rate cuts. On December 14th at 4 AM, Powell's interest rate decision maintained the status quo. However, the market misinterpreted Powell's fairly ordinary remarks as an indication of an imminent decline in interest rates. As a result, interest rates plummeted, the USD/JPY (dollar-yen) exchange rate experienced a sharp decline, and the stock market surged.

日本市場は米株の暴騰につられて上昇すると思いきや、先物の仕掛けで下落、翌日上昇した。日本市場は先物で簡単に動く、ヘッジファンドにとっては稼ぎやすいお財布状態だ。The Japanese market initially rose, seemingly influenced by the surge in U.S. stocks, but it fell due to futures manipulation, followed by a subsequent rise. The Japanese market easily fluctuates with futures trading, creating favorable conditions for hedge funds to profit.

日本の金利は低下する米金利につられるように低下。メガバンク株は軒並み暴落した。Japan's interest rates declined in response to the decreasing U.S. rates, causing a widespread drop in major bank stocks.

来週は、19日に日銀金利決定、22日に日本インフレ率と続く。メインシナリオは現状維持で、金利上昇を期待してメガバンクを買っていた大口が投げ売りし、株価はさらに下落するだろう。Next week, there's the Bank of Japan's interest rate decision on the 19th and Japan's inflation rate announcement on the 22nd. The primary scenario is to maintain the current status. Large investors who had bought megabank stocks in anticipation of interest rate hikes might sell off, causing further declines in stock prices.

サブシナリオとして利上げもある。今週、自民党のアベノミクス信奉者の世耕参院幹事長が政治資金報告不正で失脚。世耕参院幹事長は、植田日銀総裁を国会承認する際にアベノミクスの踏襲を踏み絵のように了解させた張本人。これで植田日銀は足かせが外れ、もしかすると、黒田が作り上げたマイナス金利、YCCなどを一挙に撤廃する可能性もゼロではない。As a sub-scenario, a rate hike is also possible. This week, Seko, the Secretary-General of the Liberal Democratic Party and a proponent of Abenomics, was disgraced due to irregularities in political fund reports. Seko, as the Secretary-General of the House of Councillors in the Liberal Democratic Party, was the key figure who ensured the continuation of Abenomics like a 'pledge of allegiance' when obtaining the National Diet's approval for Ueda as the Bank of Japan Governor. With Seko's downfall, Ueda might be freed from constraints, raising the possibility of a complete repeal of policies like the negative interest rates and YCC that Kuroda had established.

ただ、利上げをすると、ドル円がさらに円高になり、円安想定で株価が暴騰していた輸出産業にダメージを与える。また、前月までアベノミクス一辺倒だった植田が手のひらを返したように利上げに走るもの考え難くはある。However, a rate hike could lead to further strengthening of the yen against the dollar, damaging export industries that had been banking on a weaker yen to drive stock prices up. Additionally, it's quite challenging to imagine Ueda, who had been strictly following Abenomics until the previous month, suddenly pivoting towards rate hikes.

雇用のさらなる悪化や逆イールド解消が歴史的に株価下落のサインであることから、市場は今後数カ月後の本格的な株式暴落に向けてチキンレースの様相を呈している。Since further deterioration of employment as well as normalization of inverse yield curve indicate the stock decline historically, market may be in a chicken race towards a major market crash coming up in few month.

トレード詳細はこちら。トレード枠利用は0。長期枠利用は0。Trade details are here. 0 limit holding at the point of weekend. Long term holding utilization is 0.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The world wide stock market crash stemming from US market crash will happen in few months.

逆イールドは健在。Reverse yield curve still presents.

外国人の現物売りは5000億円台に膨らみ、一方、先物は数日単位で5000億円単位で出たり入ったりしている。Foreigners' spot selling has expanded to the range of 500 billion yen, while futures have been fluctuating in the range of several hundred billion yen in and out over the course of a few days.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

ドル円はパウエルの弱腰発言を受けた金利低下をきっかけに暴落。The USD/JPY plummeted in response to Powell's dovish remarks, triggering a decrease in interest rates.

新値は日足は下落、週足・月足とも上昇。AI予測は日足は下落、週足、月足とも上昇。The stock is currently showing a daily decline in price while experiencing upward trends on the weekly and monthly charts. AI predictions suggest a daily decline but upward trends on both the weekly and monthly charts.

三菱商事は上昇後反落。下落トレンドからは離脱。MTC went up but showed sharp decline. Got out of downward trend.

長谷工は決算日を迎え、7-9月は増益だが、通期は据え置いた。Haseko's Q2 result was announced. July-Sep earning has increased but remain the annual result forecast unchanged.

ウクライナの領土奪還は続いているものの、兵器が不足してきている。更なる支援が必要だが、欧米の足並みは乱れつつある。米国は大統領選の結果次第でウクライナへの支援は停止する。プーチンはウクライナへの支援は続かないだろうと公言している。Although Ukraine continues to reclaim its territory, there's a shortage of weapons. Further support is necessary, but there's a growing disarray in the alignment of Western countries. The support to Ukraine from the United States will depend on the outcome of the presidential election. Putin has publicly stated that support to Ukraine will not continue.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

NYは窓を開けて急上昇。ただ、今後1年以上も高金利が継続することを忘れ去ったような急激な上げは、早晩反転するだろう。New York saw a rapid surge with windows opened. However, the sudden sharp rise, seemingly forgetting that high interest rates will continue for over a year, will likely reverse sooner or later.

AIの革新はすさまじい。ただ、総人口の消費をシフトさせる経路はまだ不明確だ。既存のハイテク業界に要素技術として取り込まれて、そこから新しいサービスなどの形で大ヒットするのだろうか。The innovation in AI is astounding. However, the path to shift overall consumption patterns in the population remains unclear. It might get incorporated as an elemental technology in existing high-tech industries, leading to the emergence of new hit services or products from there.

現在、SPXの25%がGAFAMにより占められている。マイクロソフトはWindows、オフィスで人類の生産性向上を飛躍的に向上させることで大ヒットした。Googleはインターネット検索エンジンから始まりネットの利便性を飛躍的に向上させることで大ヒットした。劇的な登場を遂げたLLMを誰がどのように大ヒット商品に仕立て上げるかがポイント。Currently, 25% of the SPX is dominated by GAFAM. Microsoft achieved massive success by significantly improving human productivity with Windows and Office. Google soared to success by substantially enhancing internet convenience, starting with its search engine. The key lies in how someone can fashion LLM, which has made a dramatic entrance, into a blockbuster product.

どのような商品であったとしても、人々がそれに喜んでお金を払う、企業が儲かる、新しい価値を創造するものでなければいけない。アルファゼロが人類の囲碁最強者を打ち負かしたのは記憶に新しい。しかし、現時点で、アルファゼロを応用した大ヒットサービスは出てきていない。Regardless of the product, it must be something people are willing to pay for joyfully, something profitable for companies, and something that creates new value. The recent memory of AlphaGo defeating humanity's top Go players is vivid. However, as of now, there hasn't been a hit service leveraging AlphaGo's technology.

現状、LLM大成功-->GPU増産-->NVIDIA大暴騰というシナリオで動いていると思われるが、2000年のドットコムバブルのようにならないとも限らない。Currently, it seems to be moving along the scenario of LLM's massive success leading to increased GPU production and NVIDIA's soaring, but there's no guarantee it won't turn into something akin to the dot-com bubble of 2000.

NYは窓を開けて急上昇。ただ、今後1年以上も高金利が継続することを忘れ去ったような急激な上げは、早晩反転するだろう。New York saw a rapid surge with windows opened. However, the sudden sharp rise, seemingly forgetting that high interest rates will continue for over a year, will likely reverse sooner or later.

AIの革新はすさまじい。ただ、総人口の消費をシフトさせる経路はまだ不明確だ。既存のハイテク業界に要素技術として取り込まれて、そこから新しいサービスなどの形で大ヒットするのだろうか。The innovation in AI is astounding. However, the path to shift overall consumption patterns in the population remains unclear. It might get incorporated as an elemental technology in existing high-tech industries, leading to the emergence of new hit services or products from there.

現在、SPXの25%がGAFAMにより占められている。マイクロソフトはWindows、オフィスで人類の生産性向上を飛躍的に向上させることで大ヒットした。Googleはインターネット検索エンジンから始まりネットの利便性を飛躍的に向上させることで大ヒットした。劇的な登場を遂げたLLMを誰がどのように大ヒット商品に仕立て上げるかがポイント。Currently, 25% of the SPX is dominated by GAFAM. Microsoft achieved massive success by significantly improving human productivity with Windows and Office. Google soared to success by substantially enhancing internet convenience, starting with its search engine. The key lies in how someone can fashion LLM, which has made a dramatic entrance, into a blockbuster product.

どのような商品であったとしても、人々がそれに喜んでお金を払う、企業が儲かる、新しい価値を創造するものでなければいけない。アルファゼロが人類の囲碁最強者を打ち負かしたのは記憶に新しい。しかし、現時点で、アルファゼロを応用した大ヒットサービスは出てきていない。Regardless of the product, it must be something people are willing to pay for joyfully, something profitable for companies, and something that creates new value. The recent memory of AlphaGo defeating humanity's top Go players is vivid. However, as of now, there hasn't been a hit service leveraging AlphaGo's technology.

現状、LLM大成功-->GPU増産-->NVIDIA大暴騰というシナリオで動いていると思われるが、2000年のドットコムバブルのようにならないとも限らない。Currently, it seems to be moving along the scenario of LLM's massive success leading to increased GPU production and NVIDIA's soaring, but there's no guarantee it won't turn into something akin to the dot-com bubble of 2000.

米金利の今後 US FF rate forecast

FOMCでのパウエルの至極まともな答弁を利下げのサインと市場は曲解し、パーティーを始めた。The markets misinterpreted Powell's very reasonable responses during the FOMC as a signal for interest rate cuts and began celebrating prematurely.

ドル金利は、パウエルの利上げ停止の可能性メッセージを曲解、急激に下落。円金利もつられて低下。The dollar interest rates rapidly declined due to a misinterpretation of Powell's message about halting interest rate hikes, causing a drop. This decline also affected yen interest rates, leading to a decrease.

JGB10Y, UST10Y

米インフレ亢進は止まった模様。一部、景気後退のサインも見えるが、全体として景気は強く、利下げを語れる段階にはないのは明らか。It appears that the rapid rise in U.S. inflation has halted. While some signs of an economic slowdown are visible, overall economic conditions remain robust, and it's evident that we're not at a stage where interest rate cuts are being discussed.

US Core Inflation Rate

US Unemployment Rate3LB Month/Week/Day

日足のみが陰転継続。今週実際に1200を割りそうなところまで下落して、なにか空恐ろしいものを感じる。The daily trend continues to show only declines. It has dropped this week to a point where it seems likely to break below 1200, and I can't help but feel something ominously unsettling.