AI 株価予測 20240126の状況8306MUFG

Stock Price AI Forecast - 20240126 8306MUFG

日経平均は調整を開始した。今週は米ハイテク株決算が集中するため米株の乱高下が予想される。これを受けて日経平均も大きく揺れる。先週テスラの決算が伸び悩み、10%以上暴落した。その他米株指標はすべて上昇レンジ上値抵抗線付近となっており、いつ反落してもおかしくない。このため、今週の日本株は調整しそうだ。The Nikkei Average has started a correction. This week, due to the concentration of earnings reports from U.S. technology stocks, fluctuations in U.S. stocks are expected. In response, the Nikkei Average is also expected to experience significant swings. Last week, Tesla's earnings fell short, leading to a drop of over 10%. Other U.S. stock indices are all near the upper resistance lines of their rising ranges, making a pullback at any time seem plausible. As a result, Japanese stocks are likely to undergo a correction this week.

今週はまた中国株の暴落も話題になった。不動産崩壊を端緒に中国株は暴落を続けているが、中国への国際的な投資資金が中国から引き揚げられ、代わりに日本を含む他国への投資に振り向けられているということだ。円安になった日本は中国の受け皿として適当だということだろう。中国不動産の崩壊はまだ序盤と思われ、その影響が中国株の暴落だけで終わるとも考え難い。This week, the topic of discussion once again included the sharp decline in Chinese stocks. Following the trigger of the real estate collapse, Chinese stocks continue to plummet. It is noted that international investment funds are being withdrawn from China, and instead, redirected towards investments in other countries, including Japan. With the depreciation of the yen, Japan seems to be considered a suitable alternative to accommodate these funds fleeing from China. The collapse of the Chinese real estate market is believed to be in its early stages, and it is challenging to think that its impact will be limited to the plunge in Chinese stocks alone.

MUFGについては昨年来高値を一気に抜けて上昇したため、レンジ抵抗線であったが、長期的な上昇トレンドの開始と捉え、長期保有枠の4/5を買った。週末に向けて下落し、週末の終値はレンジ上限であったため今後短期的には下落する場合もあると考えられる。週足の上昇トレンドは基本揺いでいない。レンジ下方抵抗線に達したら追加買い予定。Regarding MUFG, it broke through its all-time high over the past year and surged, so I interpreted it as the beginning of a long-term upward trend and purchased 4/5 of my long-term holding allocation. It experienced a decline towards the end of the week, and since the closing price over the weekend was at the upper limit of the range, it is conceivable that there may be a short-term decline. The weekly chart does not show significant wavering in the upward trend. I plan to make additional purchases if it reaches the lower resistance line of the range.

長谷工は新値陰転1本、三菱商事とも、枠1/3を買った。

決算発表スケジュールFinancial Results Announcement Schedule

8306 MUFG 2/5 Mitsubishi UFJ Financial Group (MUFG) (8306): February 5

8058 三菱商事 2/6 Mitsubishi Corporation (8058): February 6

1808 長谷工 2/9 Haseko Corporation (1808): February 9

半導体ETFも買える局面が近づくかもしれない。The time may come soon to be able to buy semi-conductor stock ETFs.

トレード詳細はこちら。トレード枠利用は0。長期枠利用は4/5。Trade details are here. 0 trading limit holding at the point of weekend. Long term holding utilization is 4/5.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクはことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing as COVID relief funds continue to deplete.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The world wide stock market crash stemming from US market crash will happen in few months.

米逆イールドは健在。US reverse yield curve still presents.

外国人の年初からの現物買いが日経暴騰の原因であることは先週分かったが、今週は引き続き外国人の買いが継続していることが判明した。It was revealed last week that the surge in the Nikkei was attributed to foreign investors' buying of Japanese stocks since the beginning of the year. This week, it has been confirmed that foreign buying activity continues unabated.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

ドル円はドル金利の戻りにより上昇。The USD/JPY went up due to US$ interest rate recovery.

新値は日足・週足・月足とも上昇。AI予測は日足、週足、月足とも上昇。The new 3LB highs are ascending across daily, weekly, and monthly charts. AI predictions indicate an upward trend across the daily, weekly and monthly charts.

三菱商事は年初来高値達成。 MItsubishi achieved all time high.

長谷工のMACDはデッドクロス達成。Haseko achieved dead cross on MACD.

米大統領選で共和党はトランプが出馬する展開となった。ウクライナにとってトランプ政権は死を意味する。トランプが返り咲くと、世界は戦乱の混沌へと向かう可能性が高い。前回の選挙報道を詳細にフォローしてみたが、米国の大統領選は正常に運営されているとは言えない。投票者の管理もまともになされない米国の選挙が世界の運命を決めるのはあまりにも悲しい。どちらが勝つにせよ、選挙の管理は厳正にしてもらいたいものだ。厳正な選挙であれば諦めもつく。In the U.S. presidential election, the Republican Party has unfolded with the development of Trump running. For Ukraine, the Trump administration signifies a dire situation. If Trump makes a comeback, there is a high possibility that the world may head towards chaotic turmoil. Despite closely following the coverage of the previous election, it cannot be said that the U.S. presidential election is being conducted smoothly. It is disheartening that the destiny of the world is determined by the elections in the United States, where voter management is not properly carried out. Regardless of the outcome, it is crucial to have a rigorous administration of the elections. With a fair election, acceptance becomes more attainable.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

NYは窓を開けて急上昇。ただ、今後1年以上も高金利が継続することを忘れ去ったような急激な上げは、早晩反転するだろう。New York saw a rapid surge with windows opened. However, the sudden sharp rise, seemingly forgetting that high interest rates will continue for over a year, will likely reverse sooner or later.

AIの革新はすさまじい。ただ、総人口の消費をシフトさせる経路はまだ不明確だ。既存のハイテク業界に要素技術として取り込まれて、そこから新しいサービスなどの形で大ヒットするのだろうか。The innovation in AI is astounding. However, the path to shift overall consumption patterns in the population remains unclear. It might get incorporated as an elemental technology in existing high-tech industries, leading to the emergence of new hit services or products from there.

現在、SPXの25%がGAFAMにより占められている。マイクロソフトはWindows、オフィスで人類の生産性向上を飛躍的に向上させることで大ヒットした。Googleはインターネット検索エンジンから始まりネットの利便性を飛躍的に向上させることで大ヒットした。劇的な登場を遂げたLLMを誰がどのように大ヒット商品に仕立て上げるかがポイント。Currently, 25% of the SPX is dominated by GAFAM. Microsoft achieved massive success by significantly improving human productivity with Windows and Office. Google soared to success by substantially enhancing internet convenience, starting with its search engine. The key lies in how someone can fashion LLM, which has made a dramatic entrance, into a blockbuster product.

どのような商品であったとしても、人々がそれに喜んでお金を払う、企業が儲かる、新しい価値を創造するものでなければいけない。アルファゼロが人類の囲碁最強者を打ち負かしたのは記憶に新しい。しかし、現時点で、アルファゼロを応用した大ヒットサービスは出てきていない。Regardless of the product, it must be something people are willing to pay for joyfully, something profitable for companies, and something that creates new value. The recent memory of AlphaGo defeating humanity's top Go players is vivid. However, as of now, there hasn't been a hit service leveraging AlphaGo's technology.

現状、LLM大成功-->GPU増産-->NVIDIA大暴騰というシナリオで動いていると思われるが、2000年のドットコムバブルのようにならないとも限らない。Currently, it seems to be moving along the scenario of LLM's massive success leading to increased GPU production and NVIDIA's soaring, but there's no guarantee it won't turn into something akin to the dot-com bubble of 2000.

NYは窓を開けて急上昇。ただ、今後1年以上も高金利が継続することを忘れ去ったような急激な上げは、早晩反転するだろう。New York saw a rapid surge with windows opened. However, the sudden sharp rise, seemingly forgetting that high interest rates will continue for over a year, will likely reverse sooner or later.

AIの革新はすさまじい。ただ、総人口の消費をシフトさせる経路はまだ不明確だ。既存のハイテク業界に要素技術として取り込まれて、そこから新しいサービスなどの形で大ヒットするのだろうか。The innovation in AI is astounding. However, the path to shift overall consumption patterns in the population remains unclear. It might get incorporated as an elemental technology in existing high-tech industries, leading to the emergence of new hit services or products from there.

現在、SPXの25%がGAFAMにより占められている。マイクロソフトはWindows、オフィスで人類の生産性向上を飛躍的に向上させることで大ヒットした。Googleはインターネット検索エンジンから始まりネットの利便性を飛躍的に向上させることで大ヒットした。劇的な登場を遂げたLLMを誰がどのように大ヒット商品に仕立て上げるかがポイント。Currently, 25% of the SPX is dominated by GAFAM. Microsoft achieved massive success by significantly improving human productivity with Windows and Office. Google soared to success by substantially enhancing internet convenience, starting with its search engine. The key lies in how someone can fashion LLM, which has made a dramatic entrance, into a blockbuster product.

どのような商品であったとしても、人々がそれに喜んでお金を払う、企業が儲かる、新しい価値を創造するものでなければいけない。アルファゼロが人類の囲碁最強者を打ち負かしたのは記憶に新しい。しかし、現時点で、アルファゼロを応用した大ヒットサービスは出てきていない。Regardless of the product, it must be something people are willing to pay for joyfully, something profitable for companies, and something that creates new value. The recent memory of AlphaGo defeating humanity's top Go players is vivid. However, as of now, there hasn't been a hit service leveraging AlphaGo's technology.

現状、LLM大成功-->GPU増産-->NVIDIA大暴騰というシナリオで動いていると思われるが、2000年のドットコムバブルのようにならないとも限らない。Currently, it seems to be moving along the scenario of LLM's massive success leading to increased GPU production and NVIDIA's soaring, but there's no guarantee it won't turn into something akin to the dot-com bubble of 2000.

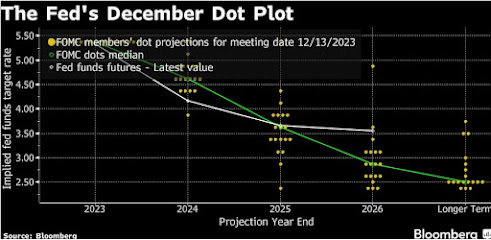

米金利の今後 US FF rate forecast

FOMCでのパウエルの至極まともな答弁を利下げのサインと市場は曲解し、パーティーを始めた。The markets misinterpreted Powell's very reasonable responses during the FOMC as a signal for interest rate cuts and began celebrating prematurely.

ドル金利は、パウエルの利上げ停止の可能性メッセージを曲解、急激に下落。円金利もつられて低下。The dollar interest rates rapidly declined due to a misinterpretation of Powell's message about halting interest rate hikes, causing a drop. This decline also affected yen interest rates, leading to a decrease.

JGB10Y, UST10Y

米インフレ亢進は止まった模様。一部、景気後退のサインも見えるが、全体として景気は強く、利下げを語れる段階にはないのは明らか。It appears that the rapid rise in U.S. inflation has halted. While some signs of an economic slowdown are visible, overall economic conditions remain robust, and it's evident that we're not at a stage where interest rate cuts are being discussed.

US Core Inflation Rate

US Unemployment Rate