AI 株価予測 20240927の状況8306MUFG

Stock Price AI Forecast -20240927

先週は26日木曜日が配当受取権利最終取引日であったが、月曜日から株価は軟調だった。自民党総裁選があり、大方の予想の高市を、石破が破り岸田の次の自民党総裁=総理大臣となった。石破の勝利を受けて、ドル円は4円下落、日経平均先物は2500円下落。石破はアベノミクスを否定(「保守政治家 わが政策、わが天命」(講談社))していたと考えられている。 Last week, Thursday the 26th was the ex-dividend date, but from Monday onward, stock prices remained weak. There was a Liberal Democratic Party (LDP) presidential election, where, contrary to most expectations, Ishiba defeated Takaichi to become the next LDP president, and thus the next Prime Minister, succeeding Kishida. Following Ishiba's victory, the dollar-yen exchange rate dropped by 4 yen, and Nikkei futures plummeted by 2,500 yen. Ishiba has been considered to oppose Abenomics, as outlined in his book, Conservative Politician: My Policies, My Destiny (Kodansha).

株式市場の大幅下落を見て、当選後のテレビ出演で従来の主張を変えて緩和継続を明言したものの、その後も下落は止まらなかった。来週の相場展開だが、早朝のドル円相場の方向がカギとなる。140円を破ってドル円が下落する仕掛けが始まると、日経平均はー2500円を超えて下落するだろう。逆に、先週末のドル円下落が逆転し、ドル高になる場合は、先週金曜日のー2500円日経平均株安は瞬間的な短期筋の仕掛けと巻き戻しで終わるということになる。Despite appearing on TV after his election and changing his previous stance by clearly stating his intention to continue monetary easing, the stock market continued to decline. Looking ahead to next week, the direction of the early morning dollar-yen exchange rate will be key. If the dollar weakens and breaks below 140 yen, it could trigger a further decline in the Nikkei beyond 2,500 yen. On the other hand, if the dollar recovers and strengthens, reversing last week's drop, the 2,500 yen drop in the Nikkei from last Friday could be seen as a temporary short-term move that will quickly reverse.

ただ、今回の総裁選に向けての上昇と下落は、噂で買ってニュースで売るの典型とも言える。上昇幅が過激だったため、高市が勝っても同様に下落していた可能性も高い。この市場の典型的な動きを石破に理解しろと言っても無理だろう。石破は「市場は短期に思惑で上下するもの」などとはぐらかしておけばよかったものを、質問の誘導であたかも自分の当選が下落を起こしたと思いこまされ、自説を曲げる不要な回答をし、言質を取られてしまったようだ。適切な経済アドバイザーを早期に手配すると良いだろう。However, the rise and fall leading up to this leadership election can be seen as a typical case of 'buy the rumor, sell the news.' Since the rise was so extreme, it’s likely that the market would have dropped even if Takaichi had won. It’s probably impossible to expect Ishiba to understand this typical market movement. Ishiba should have just brushed it off with something like 'the market moves up and down in the short term based on speculation.' Instead, he was led by the questioning to believe that his own election caused the drop, and ended up giving an unnecessary response that contradicted his views, allowing them to take him at his word. It would be wise for him to arrange for an appropriate economic advisor as soon as possible.

岸田が菅からバトンタッチした際も同様の下落があったが、その際はMUFGで現在の価格でいうと5日ぐらいかけて、1451円から1320円ぐらいまでの下落があり、その後半値戻しまで反発した。A similar decline occurred when Kishida succeeded Suga, where MUFG's stock dropped from 1,451 yen to around 1,320 yen over the course of about five days, before bouncing back to recover half of the loss.

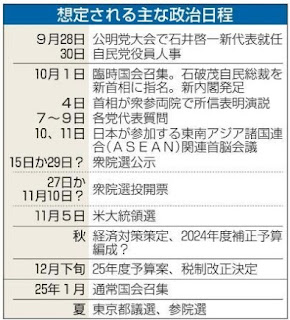

当選後のTV出演で今後の日程について石破はなるべく早い衆院解散を繰り返し主張していたが、現在のインフレによる国民生活窮乏での自民党支持率20%状態では、自民党の下野さえ可能性が高まっている。早期の解散は新たな波乱の要因となる。とりわけ、予想されている投票日は米大統領選とほとんど同じ時期となり、混乱に拍車がかかりそうだ。In his post-election TV appearance, Ishiba repeatedly called for an early dissolution of the House of Representatives, but with the current inflation-driven economic hardship and the LDP's approval rating at around 20%, there is an increasing possibility that the LDP could lose power. An early dissolution could lead to further instability, particularly because the expected election day would coincide with the U.S. presidential election, exacerbating the confusion.

なお、140円を超えて下落していった場合のリスクとして、OTCベースの円キャリートレードの巻き戻しがある。米株はキャリートレードにより支えられている面が多分にあり、キャリトレードが巻き戻されると、自動的に米株投資を引き上げるための売却が始まる。Additionally, if the yen continues to strengthen past 140 yen, there is a risk of an unwinding of yen carry trades on an OTC basis. U.S. stocks have been largely supported by these carry trades, and if they are unwound, it would automatically trigger sell-offs to pull back from U.S. stock investments.

円高による企業収益の予想EPS算定の際の基準為替レートは円高が始まった7月から修正されていないようで、EPSはドル円下落にもかかわらず上昇を続けている。現在ドル円は2024年の年初まで下落している。円高回帰修正された想定為替レートを用い、EPSが修正されると、ドル円と同様、2024年の年初レベルまで日経平均予想が下落してしまう恐れがある。Regarding corporate earnings, the forecast exchange rate used for calculating estimated EPS has not been adjusted since the yen appreciation began in July. As a result, EPS has continued to rise despite the dollar-yen decline. Currently, the dollar-yen rate is dropping toward the beginning of 2024 levels. If EPS is recalculated using an exchange rate adjusted for the yen’s appreciation, there is a risk that, like the dollar-yen rate, the Nikkei forecast could also fall back to early 2024 levels.

長期的なドル円は、米金利下げは現状5%台から2%台へ戻り、円金利上げは0.25%ずつ上げていくことにより最終的に120円台まで戻るシナリオであると予想される。そうなると、160円に及ぶ過剰な円安を享受してきた日本の輸出企業は利益が減少すると考えられる。その結果、日経平均はドル金利上げが始まった2022年4月時点の2万8千円ぐらいまで下落するだろう。In the long term, it is predicted that the USD/JPY will eventually return to the 120-yen range, as U.S. interest rates decrease from the current 5% range to around 2%, and Japanese interest rates gradually rise by 0.25% increments. If this happens, Japanese export companies, which have benefited from the excessive yen depreciation to around 160 yen, are likely to see a reduction in profits. As a result, the Nikkei average is expected to fall to around 28,000 yen, the level it was at in April 2022 when the U.S. interest rate hikes began.

ここ1ー2週間Next 1-2 Weeks:

月末が決算基準日であるが、半期で1.5%強程度の配当のためにポジションを保持するのはリスクが高すぎる。The end of the month marks the fiscal closing date, but holding positions for a dividend of about 1.5% over the half-year period carries too much risk.

10-12月October-December:

選挙は11月上旬にあり、混乱が予想されると同時に、思わぬ下落でチャンスが訪れる可能性もある。The election will be held in early November, and while chaos is expected, there is also a possibility that unexpected drops could present opportunities.

不確定要因Uncertainties:

米利下げがドル円を下落させ、それが、IMMなどの制度為替投機以外のOTCベースのキャリートレードの巻き戻しも誘起させる可能性があり、そうなると、キャリートレードベースで買われてきた米国株も手じまい売りで下落するかもしれない。A U.S. rate cut could lead to a decline in USD/JPY, which in turn may trigger the unwinding of OTC-based carry trades, not just speculative currency trades like IMM. If that happens, U.S. stocks that have been bought on the back of carry trades could also see sell-offs, causing declines.

トレードTrading:

引き続き様子見でノーポジション。Continue to stay on the sidelines with no positions.

トランプ対ハリスの討論会の結果、ハリスの支持率がトランプを上回る結果となった。As a result of the debate between Trump and Harris, Harris's approval rating surpassed Trump's.

メガバンク各社は各々、チャート上の抵抗線まで下落。Each of the megabanks has declined to the resistance line on their respective charts.

新値日足は下落。AI予測は日足が下落。週足が上昇。月足は下落。The new daily candlestick is down. AI predictions indicate the daily candlestick will decline, the weekly candlestick will rise, and the monthly candlestick will decline.

中国株は年初から再上昇を始めているが、不動産問題が更に火を噴く可能性が高く、一時的な戻りと考えられる。Chinese stocks have been rebounding since the beginning of the year, but there is a high possibility of further escalation of the real estate issue, suggesting a temporary rebound.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The crash of US commercial real estate due to the establishment of remote work has not yet been factored into the stock market.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。The underlying factor is also the collapse of Chinese real estate. The reduction of Chinese money will further accelerate the decline of commercial real estate worldwide.

米貸し出し延滞率もコロナ支援金の枯渇に伴い急速に上昇しつつある。The delinquency rate for US lending is also rapidly increasing due to the depletion of COVID relief funds.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。The crash of US stocks will likely lead to a global stock market crash within the next few months.

今週は雇用統計など、米経済減速を示す経済指標の発表が相次いだ。来週は、木曜日のインフレ率発表。This week saw the release of various economic indicators pointing to a slowdown in the U.S. economy, including employment statistics. Next week, the inflation rate will be announced on Thursday.

決算は山場を越えた。日経平均EPSに大きな変化はなかった。The earnings season has peaked. There was no significant change in the Nikkei 225's EPS.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE shows a slight recovery trend. Could intervention begin with the USD/JPY pair?

長谷工は下落トレンドから復帰。Haseko showed exit from down-trend.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

米国株はサームルール発動により景気後退入りが確実となった。

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.

FEAR&GREEDは恐怖へFEAR&GREED dived into fear.

中国株は反発するも未だ復活していない。不動産不況から始まるバブル崩壊はまだ始まったばかりかもしれない。Chinese stocks have rebounded but have yet to recover. The bursting of the bubble, starting with the real estate recession, might have only just begun.

NY株は景気後退のシグナルが其処ここに出ているのを無視して、パウエルの利下げとM7のみの好況を理由に上昇しているが、これがいつまでも続くわけはない。Despite various signs of an economic downturn, NY stocks are rising, driven by Powell's interest rate cuts and the strong performance of the M7 companies. However, this cannot continue indefinitely.

VIXは上昇。Vix has gone up.

FEAR&GREEDは恐怖へFEAR&GREED dived into fear.

米金利の今後 US FF rate forecast

米インフレの鎮静化は一時停止状態で、失業率は低下し、景気はまだ強く、インフレ圧力の復活の可能性も秘めているように見える。これがパウエルが利下げを早期に行えない原因。The pacification of US inflation remains suspended, and with a decrease in the unemployment rate and continued strong economy, there seems to be a possibility of a resurgence of inflation pressure. This is the reason why Powell cannot cut interest rates early.