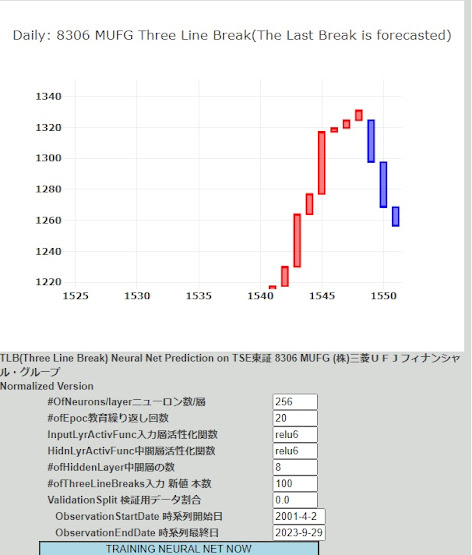

AI 株価予測 20230929の状況8306MUFG

Stock Price AI Forecast - 20230929 8306MUFG

上昇トレンドが再開したら買うつもりでいたため、先週ポジションをカットしたあと、1360円に逆指値成り行き買いを予約した。I had planned to buy when the upward trend resumed, so after cutting my position last week, I placed a limit order to buy at 1360 yen.

トレード詳細はこちら。トレード枠利用は0/3。長期枠利用は0/3。Trade details are here. 0/3 limit holding at the point of weekend. Long term holding utilization is 0/3.

しかし、配当権利落ち日28日を境に、株価は配当20.5円以上に下落していった。MUFGは25日移動平均線にはまだ到達しないが、他のメガバンクでは到達したものもある。メガバンクが他のバリュー株と同様、一様に売られている。However, since the ex-dividend date on the 28th, the stock price has declined to 20.5 yen or more below the dividend. While MUFG has not yet reached the 25-day moving average, some other mega-banks have. Mega-banks, like other value stocks, are being sold off uniformly.

メガバンクの上昇は利上げの効果というより、バリュー株の底上げという性格が強い。メガバンクがことごとく一律に上昇してきた。爆上げしたのはメガバンクだけでなく、建設、重工業など、割安に放置されてきたセクターだ。ただ、このまま上がり続けるには無理があり、どこかでメガバンクのように一旦頭を打つだろう。The rise in mega banks is more characterized by the uplift of value stocks rather than the effect of interest rate hikes. Mega banks have uniformly risen, and not just mega banks but also sectors like construction and heavy industries, which have been undervalued and overlooked, have experienced significant surges. However, it's unlikely that they will continue to rise indefinitely, and at some point, they are likely to experience a downturn, much like what happened with mega banks.

米株は、リモートワーク定着による商業用不動産の暴落が、いまだ株式市場に織り込まれていないのが最大の懸念材料。The biggest worry of US stock is the crash of US commercial real estate due to remote work, that is not really considered in the market still.

根底には中国の不動産崩壊もある。中国マネーの縮小が、世界の商業用不動産の下落に拍車をかける。Underlying impact is coming also from crash of Chinese real estate market. The shrinkage of China money will accelerate the further crash of commercial real estate market globally.

米株の急落とともに世界株式が暴落するのも、ここ数カ月以内に起こるだろう。9月末の配当を待たずして起こる可能性もある。The world wide stock market crash stemming from US market crash will happen in few months. It can happen before the dividend day in Sep end.

投資主体別統計は外国人売り継続。4月からの外国人爆買いは爆売りに変わりつつある。バリュー株は一旦撤退が良いかもしれない。Investor-specific statistics continue to show selling by foreigners. The foreign buying frenzy that began in April seems to be turning into a selling frenzy. It might be a good idea to consider temporarily withdrawing from value stocks.

PSAVEは若干持ち直し基調。ドル円は介入開始か。PSAVE is on recovery trend while USDJPY got intervention.

新値は日足は下落、週足・月足とも上昇。AI予測は日足は下落、週足、月足とも上昇。The stock is currently showing a daily decline in price while experiencing upward trends on the weekly and monthly charts. AI predictions suggest a daily decline but upward trends on both the weekly and monthly charts.

三菱商事は配当落ち後、急落。Mitsubishi Corp. experienced a sharp drop after the ex-dividend date.

長谷工も配当落ち後、急落。Haseko Corporation also saw a sharp decline after the ex-dividend date.

ウクライナは支援の条件として腐敗を防止するように要求された。腐敗度はロシアと同等のレベル。腐敗が治らないと、支援も無駄になるという訳だ。米大統領選の行方を想定してなのか、支援の足並みも若干乱れてきているのが心配。領土奪還はゆっくりだが進んでいるようだ。Ukraine has been asked to prevent corruption as a condition for receiving support, and its level of corruption is reported to be on par with that of Russia. The concern is that if corruption is not addressed, the support provided may go to waste. There is also some worry that the unity of support for Ukraine might be slightly disrupted, possibly in anticipation of the outcome of the U.S. presidential election. While the process of regaining territory may be progressing slowly, it appears to be moving forward.

米銀株、USTU10とSPX, NKY US Banks, UST10&SPX, NKY

NKYもSPXも暴落目前ムード満載のチャート。だが、現状ではまだ、米商業用不動産破綻、中国経済破綻から来る経済不安をベースとした大暴落には少し早すぎるだろう。それは、まだ米国ドルのイールドカーブの10Y-2Yが未だマイナスだからだ。暴落はこれがプラ転してから始まるのが常だ。NKY as well as SPX chart is telling that crash is imminent. However it will be a little bit early to be a real crash that originates from US commercial real estate crash as well as China economic crash. It is because US 10Y-2Y yield is still negative. Real crash normally comes after 10Y-2Y comes back to positive number.

NKYもSPXも暴落目前ムード満載のチャート。だが、現状ではまだ、米商業用不動産破綻、中国経済破綻から来る経済不安をベースとした大暴落には少し早すぎるだろう。それは、まだ米国ドルのイールドカーブの10Y-2Yが未だマイナスだからだ。暴落はこれがプラ転してから始まるのが常だ。NKY as well as SPX chart is telling that crash is imminent. However it will be a little bit early to be a real crash that originates from US commercial real estate crash as well as China economic crash. It is because US 10Y-2Y yield is still negative. Real crash normally comes after 10Y-2Y comes back to positive number.

米金利の今後 US FF rate forecast

PPIが若干昂進したが、米金利は反応せず、パウエルは利上げしないという見方が大勢だ。spite a slight increase in the Producer Price Index (PPI), U.S. interest rates have not reacted, and the prevailing view is that Powell is not inclined to raise rates.

YCC上限を1.0にしたにも関わらず、JGB10Yは0.72で日銀が介入している模様。日銀の中のアベノミクス緩和守旧派がいまだ影響力を行使しているようだ。Despite setting the Yield Curve Control (YCC) upper limit at 1.0, it appears that the JGB10Y yield is at 0.72, and the Bank of Japan (BOJ) looks intervening. This suggests that there are still influential members within the BOJ who adhere to the old Abenomics policy of monetary easing.