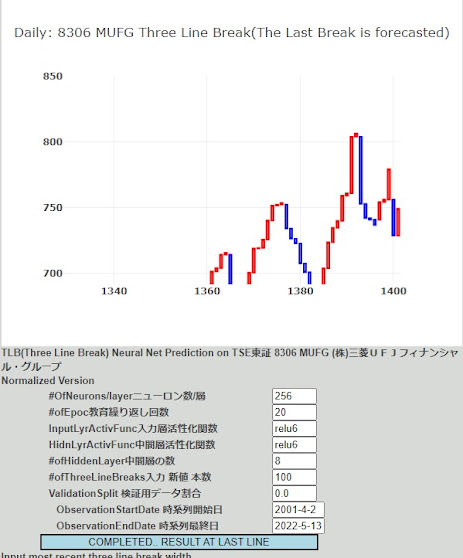

AI 株価予測 20220513の状況8306MUFG

Stock Price AI Forecast - 20220513 Status 8306MUFG

先週GW間は2日間のトレード日で大きく上昇したが、今週は、プーチンの5/9演説を挟み大きく下落した。日足は新値を更新。During last Golden Week period, stock price went up high during the 2 trading days however, price went down significant staring from Putin's speech on Monday May 9th. 3LB dropped for daily.

プーチンの演説に大きな方針転換はなかった。No big policy change observed for Putin's speech.

下落中に中期上昇トレンドと、中期下降トレンドで反発を期待して枠の1/4づつ分割購入。Purchased two times each for 1/4 of trading limit at mid term upward trend as well as mid term downward trend expecting rebound.

トレード詳細はこちら。結果的にトレード枠利用は4/4。長期保有はなし。Trade details are here. As a result, 4/4 limit holding at the point of weekend without long term holding position.

来週は決算発表が月曜日後場終了後。ロシア関連引き当て増額はあるが、大きな変化はないだろう。Next week, annual result posting is scheduled after the closing of afternoon session. No big change is expected except additional reserve for Russian related debts.

銀行株のギャップ収益面からのリスクは10年債利回りーFFレートの縮小だ。FFレートはスケジュール通り増加するが、10年債利回りが同じだけ上昇しないと、ギャップ利ザヤは縮小してしまう。現在、ロシア対応で将来の景気減速が予想されており、10年債の利回り上昇の足を引っ張りそうだ。ただ高率のインフレが継続すると10年債の利回りも上昇するため、綱引きとなる。The risk of bank from gapping earning perspective sits in the reduction of spread between UST10Y yield - FF rate. FF rate increases as scheduled however, unless UST10Y rate increase for the same basis, gapping spread will shrink. Currently future economy is expected to go slow down due to sanctions against Russia etc., hence can block the increase of UST10Y yield increase. Meanwhile, high inflation rate will be reflected to UST10Y yield hike anyway, hence UST10Y yield will go back and forth.