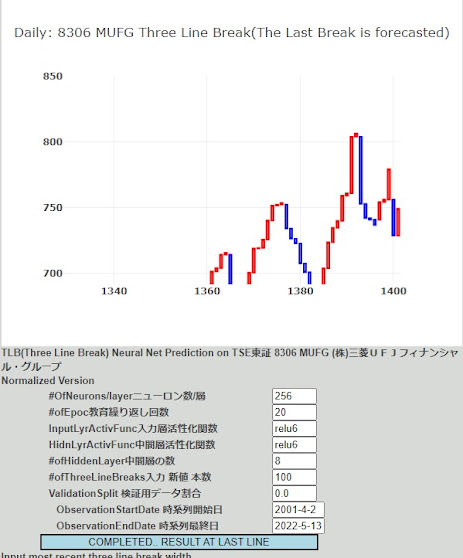

AI 株価予測 20220520の状況8306MUFG

Stock Price AI Forecast - 20220520 Status 8306MUFG

下値抵抗線に接近したため、長期保有として1/4購入。Purchased 1/4 as long term investment purpose since price came close to lower resistance of upward midterm trend.

トレード詳細はこちら。結果的にトレード枠利用は4/4。長期保有は1/4。Trade details are here. As a result, 4/4 limit holding at the point of weekend with 1/4 for long term holding position.

来週はFOMC議事録公開が水曜日で、金利動向を読んだ動きがあるだろう。中期トレンド下値抵抗線で反発せず、それを割ることがあれば、いままでのトレンドを見直す。FOMC minute will be disclosed next Wednesday and market expect some action related. If MUFG does not rebound at midterm upward trend lower range, then go through below, I will revisit the midterm upward range.

市場はハイテク崩壊とダウントレンド入り、景気後退と騒がしい。黒田は低金利を継続するようだ。Market rumor the collapse of hiTech and start of downtrend due to end of economic boom. Kuroda looks continue the low interest rate.

AI予測は続落。AI forecast is downtrend.

決算だが、トレーディング目的でない外債の値下がりが1兆円近い。FF金利が上昇することは規定路線なので、ヘッジを掛ければ良いのだろうが、出来ない理由があるのだろう。数兆円の収益機会がただ消えていく。Looking at the annual report, JPY 1tr loss came from non trading foreign securities. Should be some reason for not being able to hedge the USD interest rate hike since it is public agreement that FF interest rate will rise. Few trillion JPY revenue opportunity will just go away.

UST10の上昇にもかかわらず、バンカメはコロナ前の水準に戻った。今後UST10が6%を目指せば状況は変わるだろう。ただ、景気の悪化予想が足を引っ張っている。Bank of America(BAC) stock price came back to pre-Covid level irrespective of the rise of UST10 interest rate. Situation may change if UST10 starts to head 6% going forward. Nevertheless, deterioration forecast of economy is drugging the rise of interest rate.